The UAE's thriving economic activity is currently improving international trade links, but they can also become complicated when they are exposed to the tax system. Due to this, businesses are battling the issue of double taxation. To address this issue, the concept of obtaining a Tax Residency Certificate in the UAE appears as a solution.

The TRC is a certificate that allows qualifying government entities, businesses, and people to take advantage of double taxation treaties signed by UAE. For natural persons, the applicant must have been a resident of the UAE for at least 180 days whereas for legal persons, he/she must have been established for a period of at least one year.

Your Tax Residency Certificate (TRC) in the UAE can be quickly obtained easily with the help of financial institutions like BMS Auditing. You can reduce the burden of taxation and benefit from adherence to a double taxation treaty by acquiring a Tax Residency Certificate in UAE, Dubai. Any business that has been operating in the country for at least a year, whether it is based on the mainland or in a free zone, is eligible to apply for the Tax Residency Certificate.

Determination of Tax Resident in UAE

Natural Persons

A natural person's tax residency is determined by elements like their usual primary place of residence and the center of their financial and personal interests in a specific state. Meeting specific requirements outlined in a decision from the Minister may be necessary for this conclusion.

1. A person's usual or primary place of residence and the center of financial and personal interests are utilized to determine their tax residency. A state is considered an individual's usual or primary place of residence if the person is a permanent resident.

If the state is where these interests are most closely tied or of substantial importance, it is also regarded as the center of their financial and personal interests. The center of financial and personal interests is determined by various factors, which includes a person's profession, relationships, cultural interests, place of business, property management, and other pertinent conditions.

2. A person may be considered as a tax resident of a state if they are physically present there for 183 days or more within a consecutive 12-month period.

3. If an individual has resided in the state for 90 days within 12 consecutive months and if he is from UAE with valid residence Permit, holds the nationality of any member state of the Gulf Cooperation Council (GCC), and meets any of the following criteria:

- If a person is a permanent resident of the state.

- If he carries on employment or business activities in the state.

For conditions 2 and 3, any days or even part of a day on which the individual is physically present in the state are taken into consideration for calculating the total number of days an individual is physically present in the state throughout a relevant consecutive 12-month period.

For Juridical / Legal Person

Juridical Person is regarded as tax residents of the State if either of the following situations applies:

- It was established, organized, or acknowledged by state law. This indicates that the organization was legitimately constituted inside the boundaries of the state.

- A juridical person's tax residency is established by the applicable state tax law. The terms of the tax treaty will take precedence in determining the juridical person's tax residency status if there is a valid agreement in existence between the state and another jurisdiction to avoid double taxation and this agreement sets the criteria for establishing tax residency.

Documents Required to Obtain Tax Residency Certificate

A few important documents have to be submitted to obtain a Tax Residency Certificate, and the specific requirements may vary based on the parties involved. The following is the list of required documents for different parties:

TRC Requirements For Company

- A copy of the Certificate of incorporation.

- Corporate organizational structure.

- Copies of the directors, shareholders, or managers Passports, along with valid UAE residency visas.

- In addition to having a current UAE trade license (Mainland DED or Free Zone), the business must have been in operation for at least a year.

- A copy of the company's Memorandum of Agreement (Memorandum of Association).

- The UAE company's most recent certified audited financial statements or bank statements for the previous six months, duly stamped by the bank.

TRC Requirements For Individuals

- Copy of your Passport, your UAE Residence Visa, and Emirates ID.

- A copy of the (residential) lease agreement or Tenancy Contract Copy

- Latest Salary certificate

- The recent and verified Bank statement from the previous six months.

- A report from the General Directorate of Residency and Foreigners Affairs tracking all the entries and exits and the number of days the resident has stayed in the UAE

TRC Requirements For Investors

- Company License

- Name of the Partner

- Any other documents mentioned earlier

TRC Requirements For Housewives

- Marriage Certificate

- Copy of Passport and Residency Permits of both Husband and wife

- Partners Salary certificate and work contract.

Steps to Obtain the Tax Residency Certificate

The Steps for the Online Process of applying for the Tax Residency Certificate are as follows:

- Login or Signup for a Tax Certificate account on the FTA Portal

- If you are registered as a taxpayer already, give "Yes" in the popup message in the dashboard and enter your TRN & Email address.

- If you are a new Taxpayer, give "No" and proceed with the application

- Fill out the application for a tax residency certificate.

- Upload the required documents either in PDF or JPEG format.

- Pay the application fee for completing the application.

- The application status will be displayed on the dashboard

Pre Approval normally takes 4-5 days to complete. The UAE Tax Residency Certificate will be issued within 5-7 working days of the application being approved.

Note: If one of the members from a Tax Group wants to apply for Tax Certificate, the User should enter the Member’s TRN/TIN and email address.

Downloading Tax Residency Certificate in UAE

The user must click the "Payment Pending" option in the FTA Tax Certificate dashboard and make a payment to download the certificate. On successful Payment, a download icon is presented to click and get the certificate.

- The user will be taken to the dirham payment gateway to make the final payment.

- After a Successful transaction, the Tax Residency certificate will be delivered to the user's registered email address.

- Click on it to download

- First open the password-protected file that contains the certificate to access it.

- The password for the downloaded certificate will be the username and the last four digits of the user's mobile number.

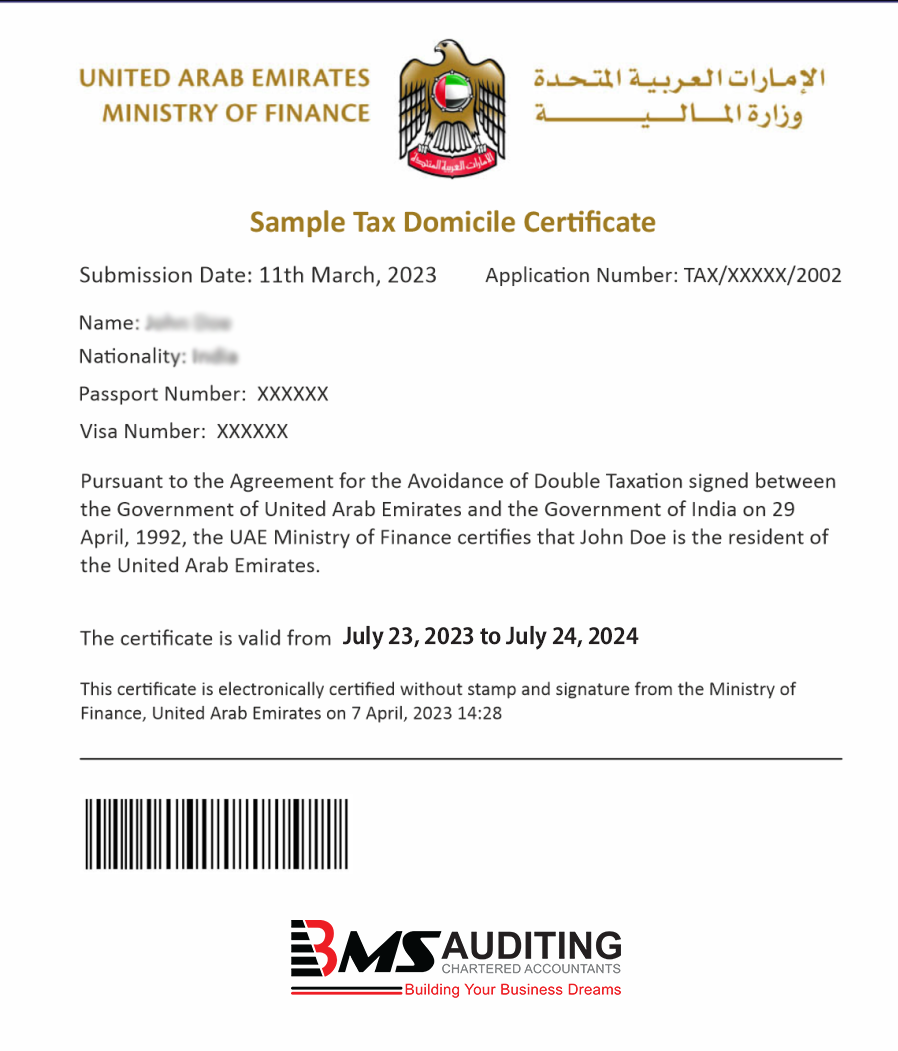

Tax Residency Certificate in UAE Sample

Validity of Tax Residency Certificate

The Tax Residency Certificate in Dubai is valid for one year beginning on the day it is issued. This certificate, often known as TRC Dubai, is accepted by both businesses and individuals. Additional certificate applications may be submitted, depending on certain conditions.

It's important to remember that offshore companies cannot get Tax Residency Certificates. These organizations instead qualify for a tax exemption certificate.

Tax Residency Certificate Fee in UAE

There are specific fees that must be paid through the e-Dirham Card to acquire the Tax Residency Certificate.

To issue the certificate:

- Pay 2,000 Dirhams + 3 Dirhams

- Payment will be made following the Ministry's final approval of the request.

To apply:

- Pay 100 Dirhams + 3 Dirhams

- Payment should be made at the time of submission.

For a duplicate, damaged, or missing original certificate:

- Pay 100 Dirhams +3 Dirhams

- The e-Dirham Card will be used to make the payment.

Benefits of Acquiring the Tax Residency Certificate

The UAE's attractive tax environment is only one of the many factors that attract business there. Now that we know why the UAE requires a Tax Residence Certificate, let's look at why acquiring one is so important:

- Income taxes for individuals and businesses are excluded.

- It greatly encourages trade between countries.

- It confirms an individual's or organization's standing in the UAE legal system.

- As you go through the import-export process, having the certificate helps you avoid paying additional taxes.

- It improves bilateral trade relations.

- Avoiding double taxes and profiting from tax exemptions are two benefits of being a UAE resident with the certificate.

- Individuals and companies can receive multiple certifications.

Tax Residency Certificate Services in UAE

To maintain compliance with tax laws and enhance your company's governance, it is essential to get competent tax counsel and guidance. A well-crafted tax strategy provides an objective evaluation of your business model and your private circumstances.

BMS Auditing is a top Tax consulting Firm in Dubai that specializes in offering services in the UAE particularly related to the Tax Residency Certificate (TRC). By helping with the required documents and certificates, our team of experts is committed to making the process easier for you and ensuring a quick and efficient completion of the TRC procedure.