As per Cabinet Decision No. 57 of 2020, UAE issued the Economic Substance Regulations (ESR) on domestic enterprises including free zones entities and those are listed in the relevant activities. ESR is mandated for UAE entities (including offshore companies and branches of domestic and foreign companies) that engage in and generate income from any of the Relevant Activities to maintain the economic substance in the UAE specific to each Relevant Activity as of 1 January 2019.

Our Management Consulting is the best in the market with consultants who are experts in all business solutions. That's why We are offering ESR Notification and ESR filing services.

What is Economic Substance Regulation (ESR)?

The Economic Substance Regulations (ESR) is a set of regulations introduced by the UAE in 2019 to demonstrate that they have a substantial economic presence in the country by conducting real economic activities and maintaining adequate levels of staffing, expenditure, and physical presence.

The regulations were introduced as part of the country's commitment to the Base Erosion and Profit Shifting (BEPS) initiative of the Organisation for Economic Co-operation and Development (OECD).

The ESR applies to companies that are registered in the UAE, as well as foreign companies that carry out relevant activities within the UAE. The relevant activities include banking, insurance, investment fund management, leasing, headquarters, shipping, and intellectual property.

ESR effectively imposes a requirement for UAE entities (including offshore companies and branches of local and foreign companies) that carry out and earn income from any of the Relevant Activities to maintain economic substance regulations in the UAE specific to each Relevant Activity. Annual filing requirements must be met or organizations risk penalties for non-compliance.

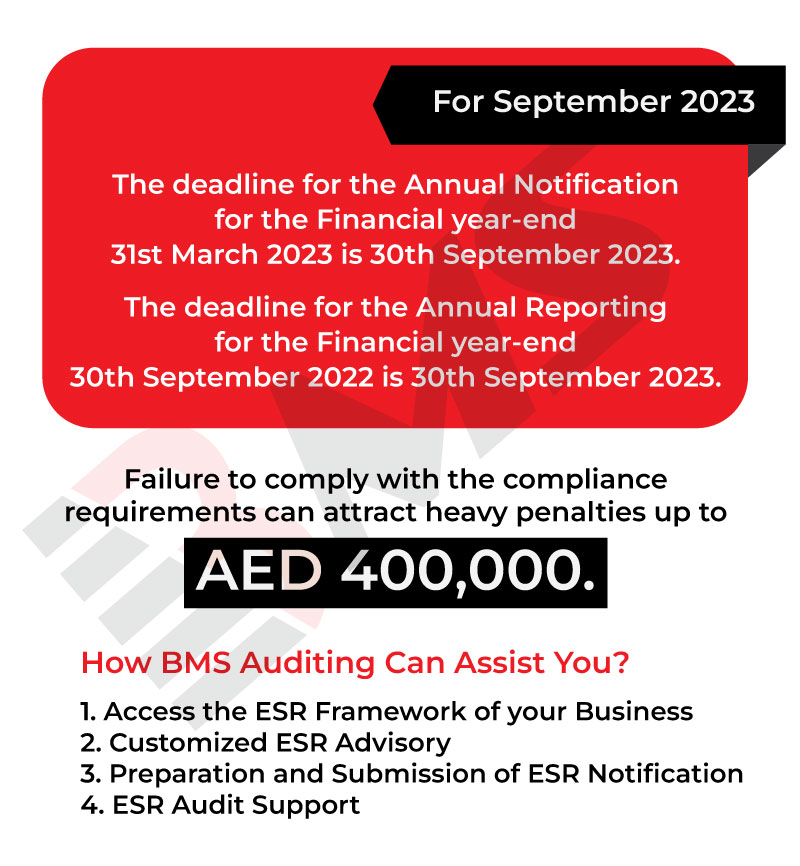

ESR Notification and Reporting Deadline for September 2023

The deadline for submitting your Economic Substance Regulation (ESR) report is approaching. The submission deadline for the Economic Substance Regulation (ESR) Annual Notification for the Financial year-end 31st March 2023 is 30th September 2023. The deadline for Annual Reporting for the Financial year-end 30th September 2022 is also 30th September 2023.

So you must finalize your report as soon as possible.

Note: Non-compliance with the ESR regulations may result in penalties, fines up to 400,000AED and even the suspension of your business activities in the UAE. It is, therefore, essential that you prioritize the submission of your ESR report and ensure that all required information is accurate and complete.

Purpose of Economic Substance Regulations (ESR) UAE

The purpose of the ESR is to prevent businesses, typically multinational corporations, from artificially shifting profits to jurisdictions that impose little or no income tax without having substantial activities in that jurisdiction to take advantage of their tax laws. The UAE is considered one of these jurisdictions.

Accordingly, the Economic Substance Regulations (ESR) impose an obligation on all entities that carry geographically mobile business activities to annually submit a comprehensive report to the authorities. The aim of this is to demonstrate that these businesses have substance and legitimate operations in the UAE. The first filing season, in relation to FY19, was completed by the end of 2020. Businesses should now be looking at the second filing season

Relevant Activities

Entities that conduct one or more of the stated activities will be subject to ESR:

-

-

-

- Banks

- Insurance

- Investment Fund Management

- Shipping

- Lease-Finance

- Headquarters

- Holding Companies

- Distribution and Service Centers

- Intellectual Property

-

-

A ‘substance over form’ approach must be adopted when determining whether an entity is carrying out any of the Relevant Activities. The assessment is required to be made for individual UAE entities. There is no applicable minimum income threshold.

ESR compliance obligations

ESR Notification

UAE entities that conduct any one or more of the Relevant Activities must file a notification within six months of the end of the financial year (FY) on the Ministry of Finance’s (MoF) online ESR portal. As part of this filing, entities must disclose which relevant activities were conducted, whether any income was earned therefrom and whether such income was subject to tax outside the UAE. In the case of a UAE entity with multiple UAE branches, only one consolidated notification is to be submitted.

Economic Substance Tests

UAE entities that have earned income from any Relevant Activity(ies) must demonstrate adequate substance in the UAE relating to such activity(ies) by satisfying the following three Economic Substance Tests (ES Tests):

-

-

-

- Core Income Generating Activity (CIGA) test requiring the core activities to be performed in the UAE

- Directed and Managed test requiring the business to be directed and managed from the UAE in relation to the Relevant Activity(ies); and

- Adequacy test requiring adequate resources (employees, expenses and assets) in the UAE

-

-

Holding companies are subject to reduced ES Tests, and High-risk Intellectual Property businesses are subject to enhanced ES Tests. In determining whether an entity has adequate economic substance in the UAE, authorities are expected to consider the impact of Covid-19 (e.g. travel restrictions, which do not allow directors to travel to the UAE for board meetings) based on a notification issued by the MoF. However, the facts in each case should be carefully reviewed by businesses and documented along with considerations regarding the appointment of alternative directors.

UAE Economic Substance Regulations Reporting

Entities that have earned income from any Relevant Activity(ies) must file a report on the MoF’s online ESR portal within twelve (12) months of the end of the relevant FY. As part of this filing, entities are required to disclose various details, including:

-

-

-

- Whether or not they have met the ES Tests

- Details of outsourced service provider(s) (if applicable)

- Details of specific CIGAs conducted

- Operating expenditure and number of full-time employees for each Relevant Activity

- Details of the parent, ultimate parent, and ultimate beneficial owner

-

-

ESR Compliance in UAE

BMS Auditing has been providing the best Management Consulting services with its large international tax team that has been extensively involved in advising clients on ESR matters. We help you with ESR filing and compliance in the following ways,

-

-

-

- Assessing whether the business activities conducted fall within any of the Relevant Activities and whether any exemption can be availed

- Assistance in filing the notification

- Assessing whether the Economic Substance Tests are met and advising on documentation to be maintained to support any future inquiries from the authorities

- Assistance in filing the report, as well as any supporting documentation

- Identify gaps between existing substance and the level of substance required under ESR and advise on remedial measures

- Assistance in responding to inquiries from the regulatory authorities/FTA

-

-

Frequently Asked Questions (FAQ)

1. What is ESR filing in the UAE?

The UAE government has put in place rules known as the ESR that are applicable to specific corporate operations carried out there. These rules are meant to make sure businesses that operate in the United Arab Emirates are real players in the local economy.

2. What is the economic substance requirement(ESR) in Dubai?

The Economic Substance Regulations (ESR) require businesses engaged in Relevant Activities to file an ESR report for each financial year in which they operate. This report provides details about the company's economic substance in the UAE for those activities.

3. What is the deadline for ESR filing in UAE?

Businesses in the UAE that are subject to the Economic Substance Regulations (ESR) ought to be informed about the current deadlines that have passed. The deadline for submitting your ESR Annual Notification had already passed on September 30, 2023, if your fiscal year ended on March 31, 2023. Companies whose fiscal year ends on September 30, 2022, have the same deadline to submit their ESR Annual Reports. Future compliance with the requirements depends on your ability to keep track of impending deadlines and turn in your ESR reports on time.

4. What is economic substance regulation?

The Economic Substance Regulations (ESR) mandate that UAE entities, including offshore companies and branches of both local and foreign firms, which engage in and derive income from any Relevant Activities, must demonstrate economic substance in the UAE specific to each of those activities.