Direct taxes are paid directly by individuals or businesses to the Government, while indirect taxes are taxes paid on goods and services by the consumer. Eligible persons should pay the taxes they are applicable to according to the country's tax laws. Hence, knowing about taxes and their importance is necessary. Here, we guide you through the difference between direct and indirect taxes.

Taxes are one of the prominent sources of income for the government of every country. These taxes are charged in various ways- salary, paying for meals at a restaurant, paying tolls when driving cars, or purchasing groceries at general stores. Being responsible citizens, it is our duty to pay taxes, and it is essential to be aware of the different types of taxes imposed on us. Taxes are of two types- Direct Taxes and Indirect Taxes.

In this session, we learn the differences between Direct and Indirect Taxes.

What are Taxes?

A tax is defined as a mandatory financial charge or any other type of charge imposed on a taxpayer by a governmental organization for funding governmental and various expenses.

Most countries have a tax policy, to pay for public, societal, or approved national needs and for the smooth functioning of the government. In some cases, taxes are charged at a flat percentage rate on personal income, while most scale taxes are increasing as per the ranges of annual income.

Taxation plays a vital role in a country's economy by providing revenue for the government to fund various projects and services such as infrastructure development, education, healthcare, and public safety. They can also influence economic behavior, such as encouraging people to save or invest by offering tax incentives or discouraging activities that are harmful to society, such as smoking, by imposing high taxes on Tobacco and other products.

Generally, Taxes can be classified into two types,

- Direct Taxes

- Indirect Taxes

Every tax that exists will be included in direct and indirect taxes. The Tax and its policies differ in a lot of countries, and it is necessary for individuals and organizations to do deep research, understand and follow the best tax practices while earning an income or starting a business.

Differences between Direct and Indirect Taxes

It is essential to understand the difference between direct and indirect taxes because they have different economic impacts and affect different people in different ways. Direct Taxes have a direct impact on the taxpayer's disposable income and can affect their spending behavior, savings, and investment decisions. Whereas, Indirect Taxes can affect consumer behavior by making certain goods or services more expensive, which may lead to reduced demand for them.

Direct Tax

A Direct Tax is a type of tax paid directly to the authority that charges the tax. For instance, the government charges income tax and you pay it directly to the government. You may note that direct taxes cannot be transferred to another individual or an entity. In every country, the concerned tax authority has the responsibility to control tax-related activities.

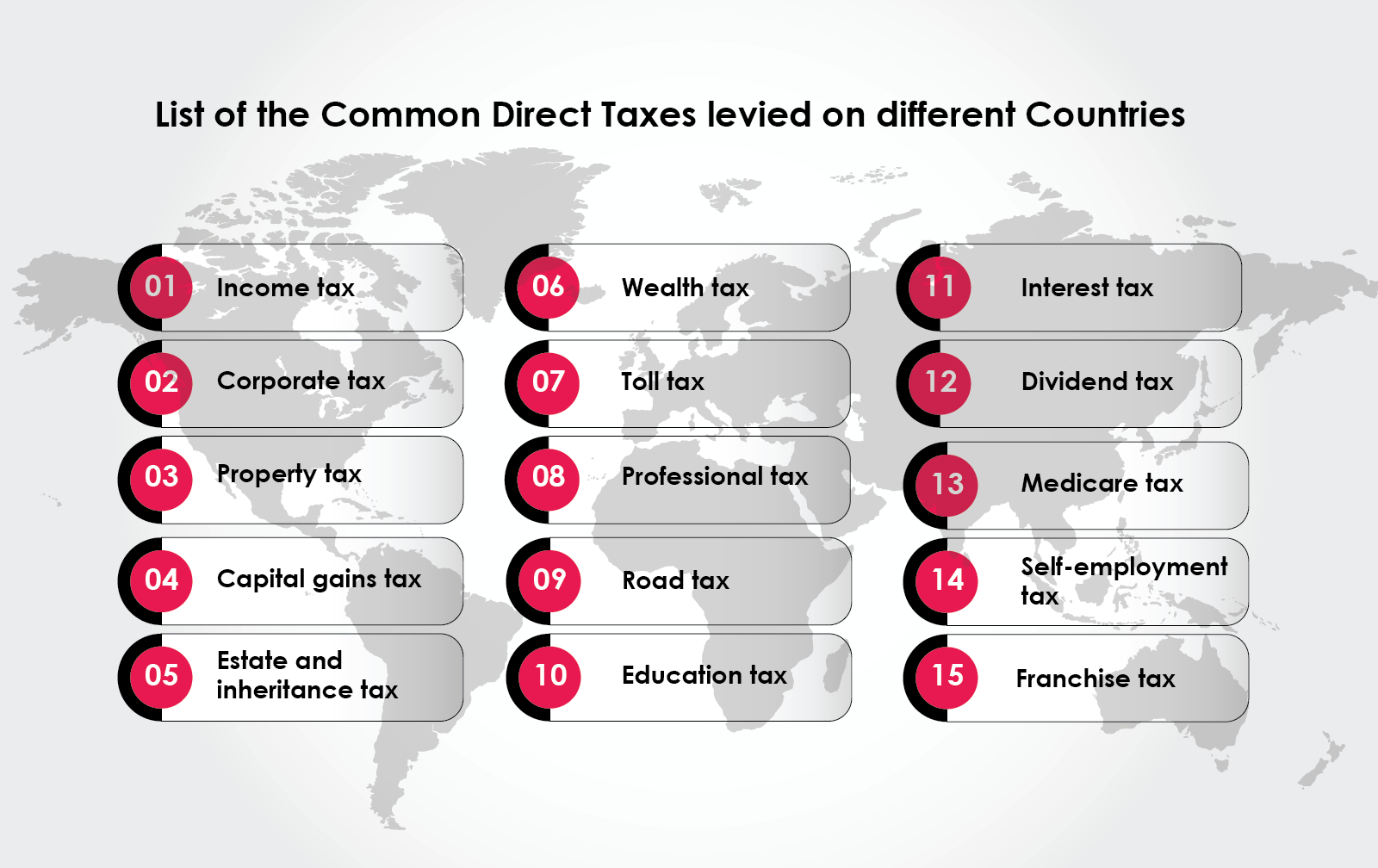

They are typically based on the income or wealth of the taxpayer, and the amount owed is calculated using a progressive tax system, meaning that those with higher incomes pay a higher percentage of their income in taxes. Here is a list of familiar direct taxes available throughout the world.

Once the tax amount is determined, the taxpayer must pay the tax owed to the government. This may be done through a variety of methods, such as electronic transfer, check, or credit card. Failure to pay the tax owed can result in penalties, interest charges, or other legal consequences.

Once the tax amount is determined, the taxpayer must pay the tax owed to the government. This may be done through a variety of methods, such as electronic transfer, check, or credit card. Failure to pay the tax owed can result in penalties, interest charges, or other legal consequences.

Indirect Tax

Indirect tax is the tax charged on consuming goods and services. These taxes are not directly charged to a person’s income. However, the taxpayer has to pay the tax along with the cost of goods and services bought by the seller. For example, when you buy a candy bar at the store, the price you pay includes an indirect tax like a sales tax. The store collects the tax from you, and then sends it to the government.

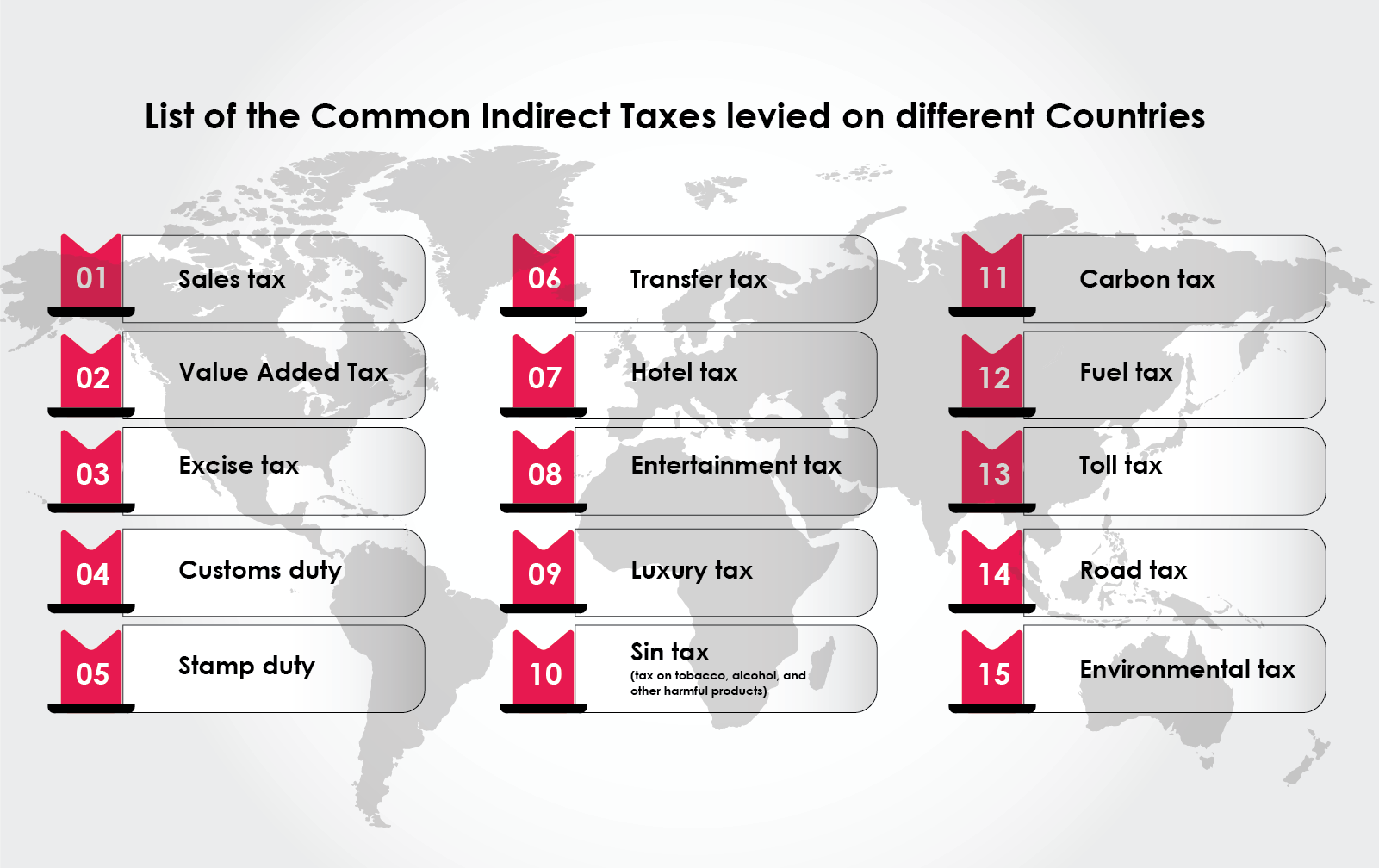

So, even if you don't realize it, you're paying indirect taxes all the time when you buy things. Here is a list of Indirect taxes available throughout the world.

Direct Tax vs Indirect Tax

Direct and indirect taxes are differentiated based on the way they are levied and who ultimately bears the economic burden of the tax. Direct taxes are taxes that are levied on individuals or businesses based on their income, profits, or assets. Whereas, Indirect Taxes are levied on goods and services rather than on individuals or businesses. Indirect taxes are included in the price of the goods or services and are paid by the end consumer.

Here is the difference between Direct and indirect taxes.

| S.no | Direct tax | Indirect Tax |

|---|---|---|

| 1 | Direct taxes are paid directly by the taxpayers to the government, and the burden of the tax falls directly on the taxpayer | The burden of the Indirect taxes is indirectly passed on to the consumer, as they ultimately pay the tax through the higher prices they pay for goods and services |

| 2 | Examples are income tax, property tax (charged on real estate), wealth tax (charged on inherited wealth), and so on. Corporate tax is imposed on corporate businesses. | Examples are Value Added Tax (VAT), GST, central excise duty, etc. VAT is imposed on the price of the product, whereas the central excise tax is imposed on the manufacture and retail of goods. |

| 3 | Collecting direct tax is a complex task unless it is deducted at the source. This happens in the case of salaried individuals.It is a different situation when collecting taxes from the business classes, where people find ways to avoid taxes, and has been difficult to identify and penalize them | The tax on goods and services is already decided and is charged along with the price of the product. Hence there are no chance of avoiding it.You can always find the taxes mentioned on the cover of a consumer product. |

| 4 | Direct tax help in improving the economy and controlling inflation. | Imposing indirect taxes leads to improving the economy but can result in inflation. |

| 5 | Direct Taxes applies only to moderate and high-earning individuals, businesses, and enterprises. | Indirect Taxes have a greater impact on low-income individuals and households than on high-income ones. |

| 6 | Direct taxes tend to exhaust a part of the income and discourage savings. When people try to avoid paying taxes, the burden of paying them falls over the smaller section of society. | In the case of savings, indirect taxes lessen personal consumption and increase savings. E.g, consumers are cautious about consuming products that are taxed extensively. |

| 7 | Direct taxes such as income tax plays a role in reducing socioeconomic inequality. The money from taxpayers is used for the welfare of the entire society, and everyone tends to benefit from the same.One of the best examples is Public transport. | Indirect taxes broaden the socioeconomic gap between the rich and the poor. Only the rich could afford better quality products which may be essential for all, while the weaker sections of society may not be able to consume certain goods. |

Should Everyone Pay Both Direct and Indirect Taxes?

Yes, it is important for eligible individuals and businesses to pay both direct and indirect taxes as they are necessary to fund public services and investments. The eligibility criteria differ based on the respective country's tax regulations and the qualifying source of income. The government separately collects both direct and indirect taxes. While direct taxes are imposed on profits and income, indirect taxes are imposed on consumable goods and services. Hence taxpayers must pay the tax regularly to avoid penalties.

Direct Taxes or Indirect Taxes, which plays an important part in the economy?

The direct and indirect taxes are roughly equal in their contribution to government revenue in advanced economies. Both taxes are necessary to fund public services and investments, and they are generally designed to with revenue-raising potential. To validate this, according to the International Monetary Fund (IMF), in 2020, direct taxes accounted for 50.6% of total tax revenues in advanced economies, while indirect taxes accounted for 49.4%.

What are the Direct and Indirect Taxes in the UAE?

In the UAE, the main types of direct and indirect taxes are

- Corporate income tax: a 9% corporate tax is to be levied on Businesses from June 1, 2023.

- Value-added tax (VAT): A 5% VAT was introduced in the UAE on January 1, 2018, on most goods and services.

- Excise tax: A 50% excise tax is applied to tobacco and energy drinks, and a 100% excise tax is applied to carbonated beverages and alcohol.

- Customs duties: Customs duties are applied to certain goods imported into the UAE, although there are exemptions for some products.

Tax Consultancy Services

Tax consultants across the world help you with relevant information on various types of direct and indirect taxes imposed in the country and ensure that people are compliant with the regulations of the government. BMS Auditing is one of the leading firms with highly experienced tax consultants and Tax agents serving global clients from UAE, KSA, Qatar, Bahrain, Oman, India, UK and USA. Our corporate tax service specialists assist you with the best tax compliance for the Tax Authorities to ensure that your business is compliant with the laws and regulations of the country.

The experts also help you with tax-related activities such as registration, return filing, or refund to prevent you from paying penalties.

Have queries regarding direct and indirect taxes? BMS is here to serve you always.

Frequently Asked Questions (FAQ)

- What is the difference between a direct & an indirect tax?

There exist two primary classifications of taxes: direct and indirect. Direct taxes, akin to income tax, entail straightforward payments made directly to the government. They directly impact individuals' finances and cannot be readily transferred to another party. On the other hand, indirect taxes involve a middleman. You pay them to a store or service provider (like sales tax) when you purchase something, and then they forward the collected taxes to the government. The burden of indirect taxes can be a little more ambiguous. Since businesses have the option to adjust prices based on the tax, the cost might be "hidden" within the final price you pay. This means the consumer may ultimately feel the impact, even though they initially pay the tax to the intermediary.

- What is meant by direct tax?

Direct taxes: Pay them directly! This includes income and property tax. Unlike other taxes, you can't pass them on - they come straight from your wallet to the government.

- Is excise tax direct or indirect?

Excise duty is an indirect tax levied on domestically made items in India. Usually, the producer or seller gathers it and then sends it to the government.

- What are the different types of direct taxes?

Direct taxes, unlike sales tax paid at stores, land directly on you. You can't transfer the responsibility – income tax, corporate tax, property tax, and gift tax in India are all prime examples. These go straight to the government from your wallet.

- Which is indirect tax?

Many taxes, like sales tax or the one on your movie ticket (entertainment tax), are indirect. These are like hidden fees businesses like stores or service providers tack onto the price. The final price you pay for your groceries or entertainment includes these indirect taxes, even though you might not see them listed separately. They're what make your purchases a little more expensive.