The Corporate Tax training in UAE by BMS is designed to introduce professionals to the new UAE federal income taxation of businesses and their stakeholders. BMS Auditing introduces Corporate Tax Training in UAE to upskill and prepare fellow accountants, auditors, tax professionals, and tax agents in UAE on the new UAE Corporate tax regime.

The introduction of the new corporate tax system marks a significant shift in the UAE's tax landscape and provides new opportunities for businesses operating in the country. The 9% corporate tax rate in the UAE is part of the country's efforts to create a more attractive business environment and attract foreign investment. For Accountants and tax agents in UAE, it is important to understand the new tax system and its implications, including the tax obligations and exemptions that apply to business operations.

What is Corporate Tax Training in UAE About?

Corporate Tax Training helps professionals enhance their knowledge of the UAE Corporate Tax and how the government implements this new system. This is a detailed training program where the candidates learn the basics of business tax returns and the tax charged on business profits.

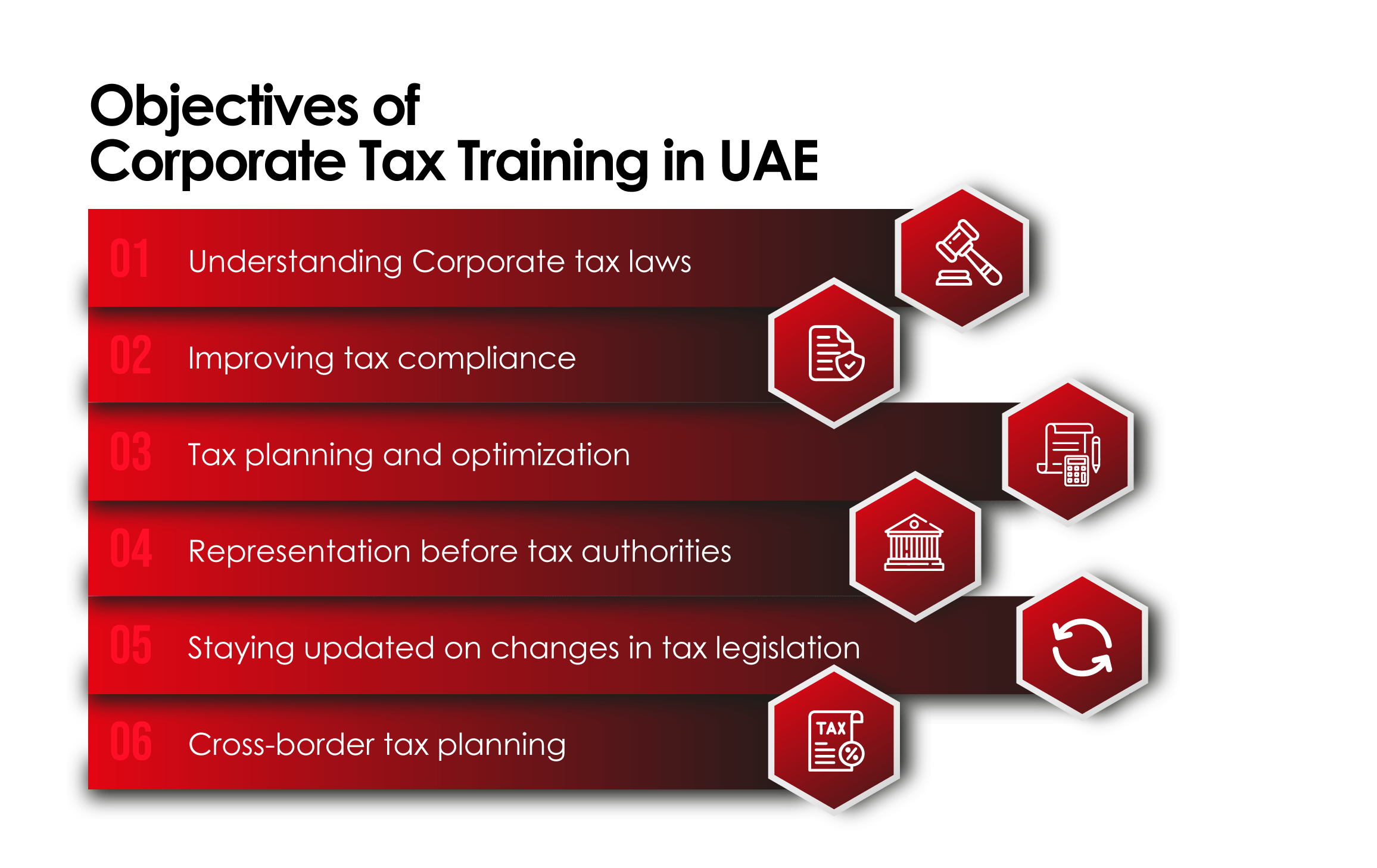

Objective of Corporate Tax Training in UAE

The objective of this training is to equip participants with the knowledge and skills needed to provide effective tax planning, compliance, and advisory services to their clients. The training is designed to help participants understand the intricacies of the tax system in the UAE and to provide practical guidance on how to minimize tax liabilities and maximize tax savings for their clients.

The corporate Tax Training in UAE module covers the essential concepts of Corporate Tax, such as Corporate Tax rates, the CT Registration process, Return Filing, Corporate Tax Accounting, Fines & Penalties, etc. The main objective of this training program is to provide accurate knowledge of Corporate Tax to the tax accountants, Tax agents and Tax consultants in Dubai. Hence, they understand how to handle the UAE Corporate Tax.

From our training session, you can ensure that your business is compliant with the rules and regulations of the Federal Tax Authority. The Corporate Tax Training helps you correctly and efficiently implement Corporate Tax in the organization. The tax experts at BMS also provide practical and real-time training to enhance the knowledge and understanding of Corporate Tax and all its related aspects.

Modules of Corporate Tax Training in UAE

Our UAE Corporate tax training Module is specially curated to teach you all the corners of Corporate Tax and make you an industry expert on it.

|

S.No |

Modules of Corporate Tax Training in UAE |

|

1. |

Basic Concepts

|

|

2. |

|

|

3. |

Corporate Tax Registration & De-registration

|

|

4. |

Corporate Tax Calculation |

|

5. |

|

|

6. |

Refund & Payment

|

|

7. |

Corporate Tax Relief |

| 8. |

Tax Deductions & Expenditure |

| 9. |

Taxable Person & Corporate Tax Base

|

| 10. |

Free Zone Person |

| 11. |

Tax Loss Provisions

|

| 12. |

Violations & Penalties in Corporate Tax

|

| 13. |

Transitional Rules |

| 14. |

Closing Provisions |

Why is Corporate Tax Training Important?

The Corporate Tax Training helps to train the participants on the basic concepts of Corporate Tax and its impact on the operational and financial performances of the businesses in the country. Without proper knowledge of UAE CT, a tax expert may fail in proper registration, filing, payment and other tax procedures. This can lead to businesses getting subjected to corporate tax fines and penalties in UAE.

Through this training, the participants explore the scope of Corporate tax and its calculations. The training helps the professionals develop their knowledge and skills for effective performance in the profit taxation process of the business.

Who Should Take Corporate Tax Training?

This exclusive training program is for

- Business owners and managers: Understanding the corporate tax system in the UAE is crucial for business owners and managers to make informed decisions about their operations and ensure compliance with tax laws and regulations.

- Tax professionals and Accountants: Tax professionals, including accountants and tax advisors, need to stay updated on the latest developments in the UAE corporate tax system to effectively advise their clients on tax compliance and planning.

- Human resources professionals: HR professionals responsible for payroll and employee compensation need to be aware of the tax implications of their actions, such as tax withholding and reporting obligations.

- Foreign companies operating in the UAE: Companies operating in the UAE, especially those from foreign countries, can benefit from corporate tax training to better understand the tax environment and take advantage of tax incentives and benefits available to them.

- Government and public sector employees: Employees in the government and public sector can also benefit from corporate tax training to improve their understanding of the tax system and help them better fulfill their responsibilities in tax administration and compliance.

Others:

- Professionals seeking deep knowledge of Corporate Tax, or an employee of an organization at a mid-senior level position, holding operational or supervisory responsibilities, or both.

- Aspirants from the audit department of a corporate business (with a profit margin of over AED375,000) who wishes to perform corporate tax returns online themselves.

- Anyone who wishes to learn more about Corporate Tax.

Enroll for Corporate Tax Courses in UAE

BMS Auditing has professional and certified trainers specialized in taxation. With offices in both Dubai and Abu Dhabi, we have been providing world-class tax services for businesses in UAE. Hence, our trainers have extensive experience in training all kinds of people, from new employees to senior managers, and auditors.

Our trainers have exclusive knowledge of Corporate Tax and provide high-end training sessions for corporate employees as well as independent tax professionals. They cover all the essential aspects so that the candidates get complete knowledge of Corporate Tax.

Want to enroll in Corporate Tax Training? Give us a call for more info on the training program!