Providing the best corporate tax services, BMS assures a professional and timely corporate tax registration in UAE to comply with the new UAE CT regime. Getting to know about corporate tax law and its registration procedures is vital for any UAE business. So, here is the guide.

As you may know, the Ministry of Finance in the UAE launched the Corporate Tax in 2022 and will be implemented in full swing during June 2023, to impact the financial years of the companies or the businesses. Hence, audit firms in Dubai and tax consultants in the UAE have started offering Corporate Tax Advisory and Implementation Services for Businesses. The Corporate Tax system in the UAE strictly follows the best global practices and regulations issued by the OECD (Organization for Co-operation and Economic Development) to minimize the risk compliance on business.

Registration for Corporate Tax in UAE

As per the FTA's Federal Decree Law 47, The corporate tax regime demands every taxable person, which includes a Free Zone Person, requires to register for Corporate Tax and get a Registration Number. The Federal Tax Authority also requested that even the Exempted Persons should register for Corporate Tax.

Taxable Persons must file Corporate Tax returns for a Tax Period within 9 months from the end of a specific period. This deadline is normally applied in the payment of all the Corporate Taxes due in terms of the Tax Period the return is filed.

In the cases excluded as declared by the Minister, a Taxable Person must register for the Corporate Tax with the Federal Tax Authority in a specific format, within a timeline declared by the authority.

The Authority requires the Taxable Person or the Independent Partnership, to register for Corporate Tax and obtain the Tax Registration Number. The Tax Authority should have a unique judgment for Corporate Tax Registration from the day an individual becomes a Taxable Person.

Once the registration of corporate tax is completed, the tax persons have to pay a standard rate of Corporate Tax of 9% on taxable income above AED375,000, while taxable income up to AED375,000 is charged 0%.

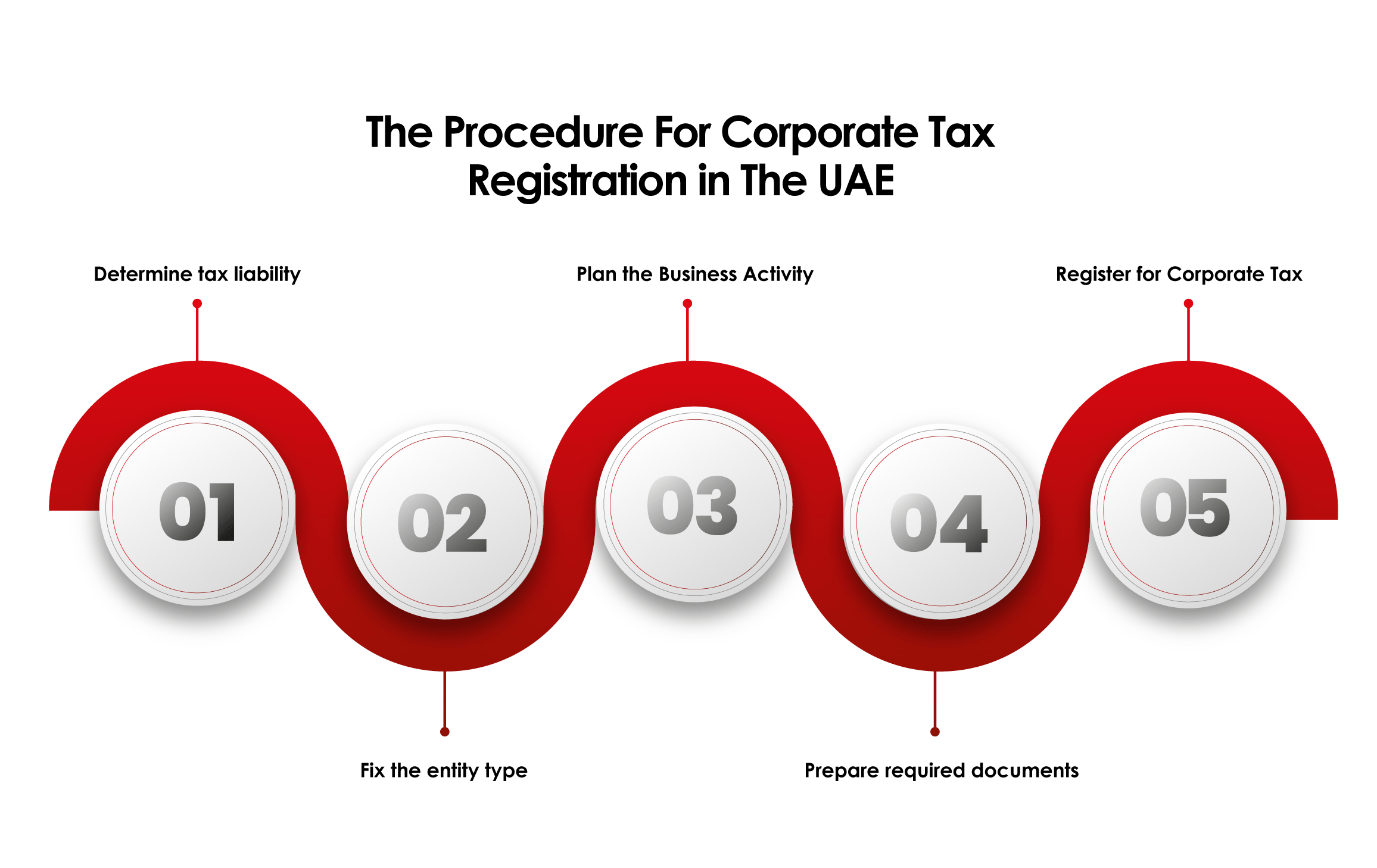

How to register For UAE Corporate Tax?

The Federal Tax Authority has announced pre-registration of corporate tax in the EmaraTax platform. It is an online portal for taxpayers to handle all the Tax registrations, returns, refunds, deregistration and payment in one platform. One can also make VAT Payments easily using the EmaraTax user-friendly portal.

You can create an account or migrate your FTA Account to the EmaraTax using this simple EmaraTax Login guide. You may need to submit all the required documents for corporate tax UAE and register for corporate tax successfully.

Here is the user manual to register for corporate tax in Emaratax

Need for Corporate Tax Registration in UAE

The UAE Governance and the Ministry of Finance have come up with a tax structure and laws that could benefit the companies that pay corporate tax. If you are a business who are subjected to corporate tax, you can have the following advantages,

- Staying compliant with the tax law and following up on changes

- Identifying malicious tax practices

- Following the world-class tax standards

Corporate Tax registration is also important to minimize the after-tax revenue of the companies, thus return to shareholders. This not only impacts the individuals with direct shareholdings but also the indirect shareholders via private pensions or investment funds.

Corporate tax payments provide more advantages to business owners, rather than paying additional income tax individually.

Who is exempt from UAE Corporate Tax?

Although the Federal Tax Authority requested that the Exempted Persons should register for Corporate Tax, the exempted business has to pay a 0% of corporate tax.

There are categories that are exempted from Corporate Tax. Let us look at some of them:

- The employee’s salary will not be affected by Corporate Tax. However, if the individual gets income from activities conducted under a freelancing license, then he/she will be charged with the company tax

- Shares or similar assets resulted in dividends, capital gain, or any income earned by personal potential

- Investment in real estate is legal in the UAE until the investor has no business license

- Potential intra-group transactions or reorganizations will not be affected by the Corporate Tax

- Corporate Tax will not be charged on the foreign investor’s income from dividends, gains, royalties, and similar investment returns unless obtained through business or business activity

If you own a business in UAE, read to know if your entity is exempted from corporate tax or not

Who should register for Corporate Tax?

Every Taxable person, including Free Zone person, needs to register for Corporate Tax and get a Registration Number.

As per the UAE Law for Corporate Tax, there are conditions for tax registration, which are as follows:

- Mandatory Registration

- Registration at the choice of FTA

If your business is taxable under the Corporate Tax policy, you should apply for Corporate Tax registration in the UAE. Once registered you must obtain a Tax Registration Number within a specific period. Tax consultants at BMS Auditing help businesses with the registration process for Corporate Tax.

The Federal Tax Authority requests certain individuals such as Exempt persons, autonomous partnerships, etc. to register under the Corporate Tax policy, and obtain the Tax Registration Number.

Timeline for Corporate Tax Registration

The registration process for Corporate Tax begins in early 2023. For example, a business with the initial tax period starting from June 2023, should register for Corporate Tax within 26 months- January 2023, and the return filing date is February 2025. Once registered, businesses in the UAE will have up to nine months from the end of the relevant tax period to file their tax returns to the Federal Tax Authority and pay the Corporate Tax.

Skip directly to Steps to Register for Corporate Tax in EmaraTax

Why Corporate Tax Assessment is necessary before Registration?

One should assess the risks and law factors of a business on pre and post-implementation of corporate tax. In such a way, you can be compliant with the tax regime of the country. Without a proper assessment of Corporate tax requirements for a business, one may be subjected to Corporate tax fines and Penalties. The assessment before the corporate tax includes the impact assessment, the document assessment, and the tax compliance assessment. It is recommended that the assessment should be done with professional corporate tax consultants or firms that offer quality Corporate tax assessment Services.

Down below, we discuss Corporate Tax Registration services that help to make your registration process go smoothly and efficiently.

Corporate Tax Registration Services

BMS Auditing has the most qualified and experienced tax consultants with extensive expertise in Corporate Tax registration. BMS has tax advisors who provide quality services in the registration process for Corporate Tax.

Our team is quite aware of the major changes resulting from the implementation of Corporate Tax. The early preparation of corporate tax compliance saves a lot of costs and minimizes the stress on the team. With the extensive expertise and experience of the tax consultants at BMS, you can be assured of smooth and unlimited transformation.

BMS assists you with updates on Corporate Tax Registration and filing CT returns, so you stay compliant with the regulations and save from fines and penalties.

Have queries on Corporate Tax Registration for your business? Call BMS Auditing Dubai or BMS Auditing Abu Dhabi.

Frequently Asked Questions (FAQ)

1. How much is corporate tax in the UAE?

Participating Interests in the UAE are taxed at a 9% effective tax rate (ETR) on their income. This ensures all Participating Interests, regardless of their home jurisdiction's tax laws, contribute a minimum level of tax to the UAE. If a Participating Interest's home tax laws wouldn't naturally result in a 9% ETR, the UAE CT Law will recalculate the rate to reach that threshold.

2. Is there a deadline for corporate tax registration in the UAE?

The filing window for businesses whose tax period runs from January 1, 2024 to December 31, 2024 is from January 1, 2025, to September 30, 2025, for the submission of their corporate tax return and payment. Don't forget to meet this deadline to stay out of trouble!

3. How can I register my company in the UAE?

The Department of Economic Development in the emirate where you intend to locate your business is where you may submit an application in person. Furthermore, there are digital systems that let you register a business online and get a commercial license; you may submit the required paperwork and have a license in a matter of minutes.

4. How to register for corporate tax in uae?

To register for Corporate Tax on EmaraTax, log in or sign up for an account. Add a Taxable Person if needed and select 'Register' in the Corporate Tax section. Follow the guidelines, fill in entity details, add business activities, owners (if applicable), and branch details. Enter contact information and authorized signatory details. Review all information, declare its accuracy, and submit your application.

5. Corporate tax registration fees in uae?

UAE resident businesses must register for VAT if their taxable supplies exceed AED 375,000, while voluntary registration is available if supplies reach AED 187,500. Non-resident businesses must register for VAT regardless of their turnover if they make taxable supplies in the UAE.

6. What are deductible expenses in the UAE?

While most normal business costs in the UAE are tax-deductible, some are off-limits. These include illegal payments like bribes and fines, taxes you already pay like corporate tax and unrecoverable VAT, and money leaving the company like dividends and foreign taxes. Even entertainment gets special treatment - only half the cost is deductible. For specifics on your business, consult a tax advisor.