Corporate Tax Impact Assessment is a structured and systematic process for considering the implications of corporate tax for businesses while there is still an opportunity to make necessary changes within and outside the standalone business unit or the group. BMS has a squad of competent corporate tax specialists that can effectively conduct corporate tax impact assessment services in UAE to ensure tax compliance.

BMS tax agents offer corporate tax assessment services in UAE to analyze the impact, document requirements and compliances to make the right tax decision. Our expert corporate tax advisors deal with Corporate Tax, and assist their clients with all the aspects of Corporate Tax and stay compliant with the tax regulations.

The UAE and the businesses established here are preparing themselves for the implementation of Corporate Tax in June 2023. The Corporate Tax policy is created to execute the most effective practices globally and minimize the risks in the businesses. The standard rate of Corporate Tax is 9%, and profits up to AED 375,000 is 0% to support small businesses and startups, thus becoming one of the most competitive policies in the world.

In this session, we look into Corporate Tax Assessment services in the UAE.

What is a Corporate Tax Assessment in UAE?

Upon implementing corporate tax, it is required to assess the amount of tax a company needs to pay to the government based on its revenue. It involves calculating the income, applying tax rates, and considering any deductions or exemptions it may be eligible for.

A corporate tax assessment is an organized procedure to consider suggestions for businesses, where there is a potential to make relevant changes within and outside the business unit or a group. The ultimate result of an assessment is creating a base for effective Tax Planning, Business reconstructing and executing sufficient compliance verifications. Our corporate tax assessment services are a part of our Corporate Tax services in UAE where we provide holistic corporate tax solutions for your business. So, we would like you to check it out!

We can divide the overall corporate tax assessment process into three different processes,

- Impact Assessment

- Document Assessment

- Tax Compliance Assessment

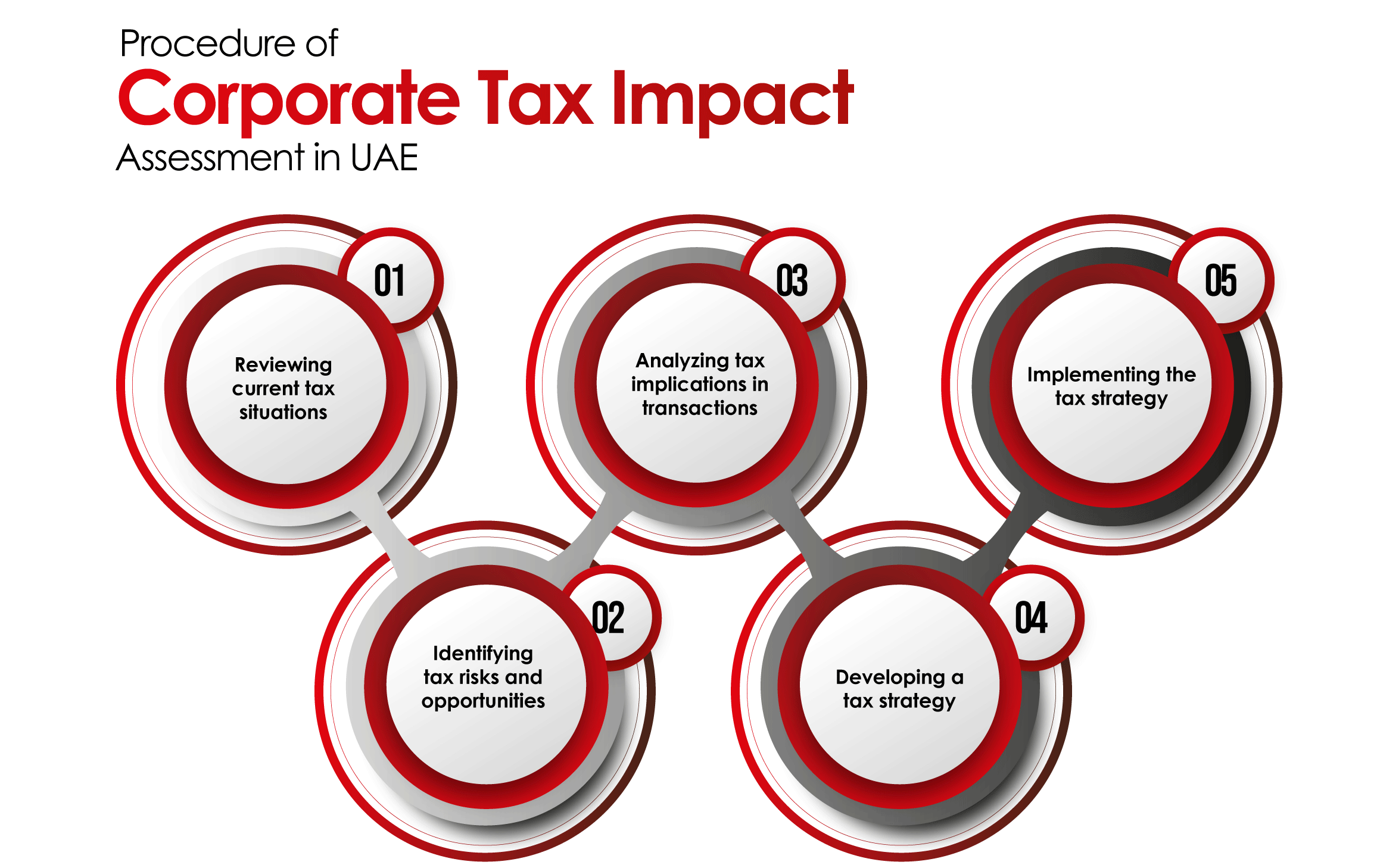

Corporate Tax Impact Assessment in UAE

Corporate Tax Impact Assessment in UAE is a process of evaluating the potential impact of tax laws, regulations, and policies on a company's financial performance. This involves analyzing the company's current tax position, identifying tax risks and opportunities, and recommending strategies to optimize tax efficiency.

The aim of Corporate Tax Impact Assessment in the UAE is to help companies make informed decisions on tax planning and ensure compliance with local tax laws. Realizing the actual impact of Corporate Tax on your business is more important before implementing it. This helps to minimize tax liabilities, maximize tax savings, and achieve long-term business success.

The aspects of a Corporate Tax Impact Assessment in the UAE typically include:

-

Tax compliance: Evaluating the company's compliance with the tax laws and regulations in the UAE, including the submission of tax returns and payment of taxes owed.

-

Tax planning: Identifying opportunities to minimize tax liabilities and optimize tax benefits, such as claiming tax credits and deductions.

-

Transfer pricing: Evaluating the transfer pricing policies of the company to ensure compliance with tax laws and regulations, including the transfer of goods, services, and intellectual property between related entities.

-

Business structures: Analyzing the current business structure of the company and considering any changes that may be necessary to minimize tax liabilities and optimize tax benefits.

-

Tax incentives and exemptions: Evaluating the company's eligibility for any tax incentives or exemptions offered by the UAE government, such as free zone status.

-

International tax considerations: Analyzing the impact of cross-border transactions on the company's tax position and ensuring compliance with international tax laws and regulations.

Our Corporate Tax advisors in Dubai help you decide the best business and financial plan to cope with the impact of UAE Corporate Tax.

Document Assessment for Corporate tax in UAE

Businesses will be mandated to keep financial and other records in order to comply with UAE corporate tax Document requirements. Failure to meet these requirements may result in significant corporate tax penalties in the UAE, which the government may announce soon. You must save the files and records that explain the information on the UAE corporate tax return and other documents filed to the FTA.

BMS Corporate Tax Advisors and consultants can help you have a clear understanding of compliance requirements and guide you to maintain the list of documents.

Corporate Tax Compliance Assessment in UAE

The UAE's corporate tax regime will be based on the concept of self-assessment. It implies that firms must ensure that their tax returns and accompanying schedules are proper, accurate, and in accordance with UAE Corporate Tax Law. You should be aware that the FTA may conduct a review of the filed company tax returns and provide an assessment within the period.

Taxpayers may, however, appeal an amended business tax assessment given by the FTA. As a result, you may be able to appeal and revise the adjustments to comply with the laws. The method for contesting the FTA assessment will be specified in sooner.

Our Corporate Tax advisors have complete knowledge of the Tax regime and can guide you to comply with all the laws and regulations properly.

How to do Self corporate tax assessment with FTA Tax Clarification?

FTA has created a portal to clarify your tax preparation. If a planned tax preparation or transaction raises concerns, businesses can request clarification on the proper or intended corporate tax treatment. You may submit requests for corporate tax clarification to the FTA. Currently, the FTA offers clarification on any corporate tax uncertainty using the same mechanisms as the Value Added Tax (VAT) clarification.

Better relying on professional corporate tax consultants can help you evade the confusion and best practices regarding corporate tax law.

Corporate Tax Assessment Services in UAE

BMS Auditing has a highly experienced team of Corporate Tax consultants in Dubai that has specialized in Corporate Tax assessment. The team helps you with the following:

- Assessing tax outcomes for the business

- Evaluating the eligibility of Corporate Tax and suggesting related exemptions to the mainland, free zone and offshore businesses

- Evaluating and analyzing the possibility of tax grouping to obtain tax benefits

BMS offers premium corporate tax services in UAE to assist you to Register for CT, File corporate tax returns and be compliant with the Corporate Tax laws and protect you from fines or penalties.

Have queries regarding Corporate Tax Assessment?? BMS auditing is delighted to serve you anytime, anywhere!