EmaraTax has been launched. Let's take a closer look at how to make VAT payments to Federal Tax Authority (FTA) on Emaratax portal using each payment method. GIBAN or FAB Magnati.

If you haven't registered for EmaraTax yet, here are the steps to register for EmaraTax and enter your Business details. Once registration is done, you can proceed to the VAT Payment on the EmaraTax portal. Here is how to do it so,

Methods of VAT Payments on EmaraTax

There are two methods of VAT payment on the EmaraTax portal:

1. Via GIBAN

2. Via FAB Magnati

Read How to download the VAT Certificate on Emaratax?

Procedure to make VAT Payments to Federal Tax Authority (FTA) on EmaraTax Portal

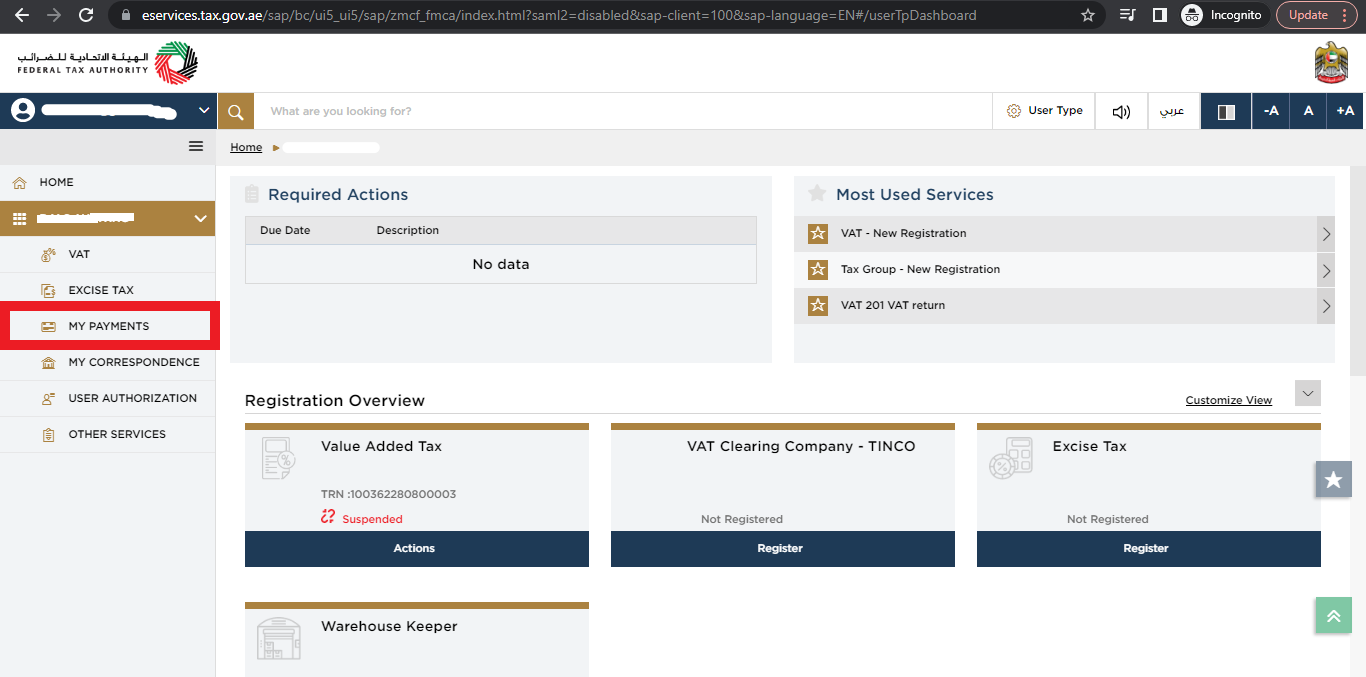

Step 1 - Login to Emaratax portal using your Federal Tax Authority (FTA) credentials.

Step 2 - Click on 'My Payments'

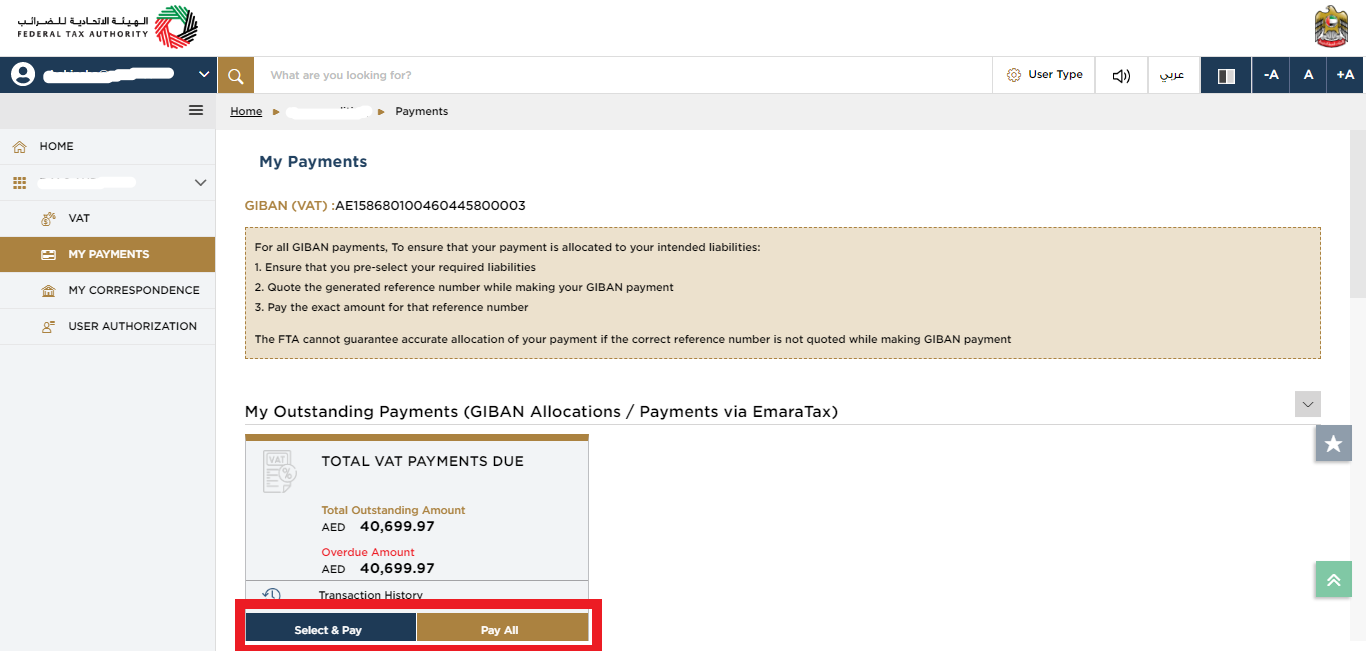

Step 3 - a) Click on 'Select & Pay' if you want to choose whether you want to pay for the tax liability or a fine amount. If you choose 'Select & Pay', it will show you a list of pending payments including tax liability or any other kinds of fine you have and then you can choose which amount you want to pay.

b) Click on 'Pay All' if you want to pay all the tax liability and Fines (if any)

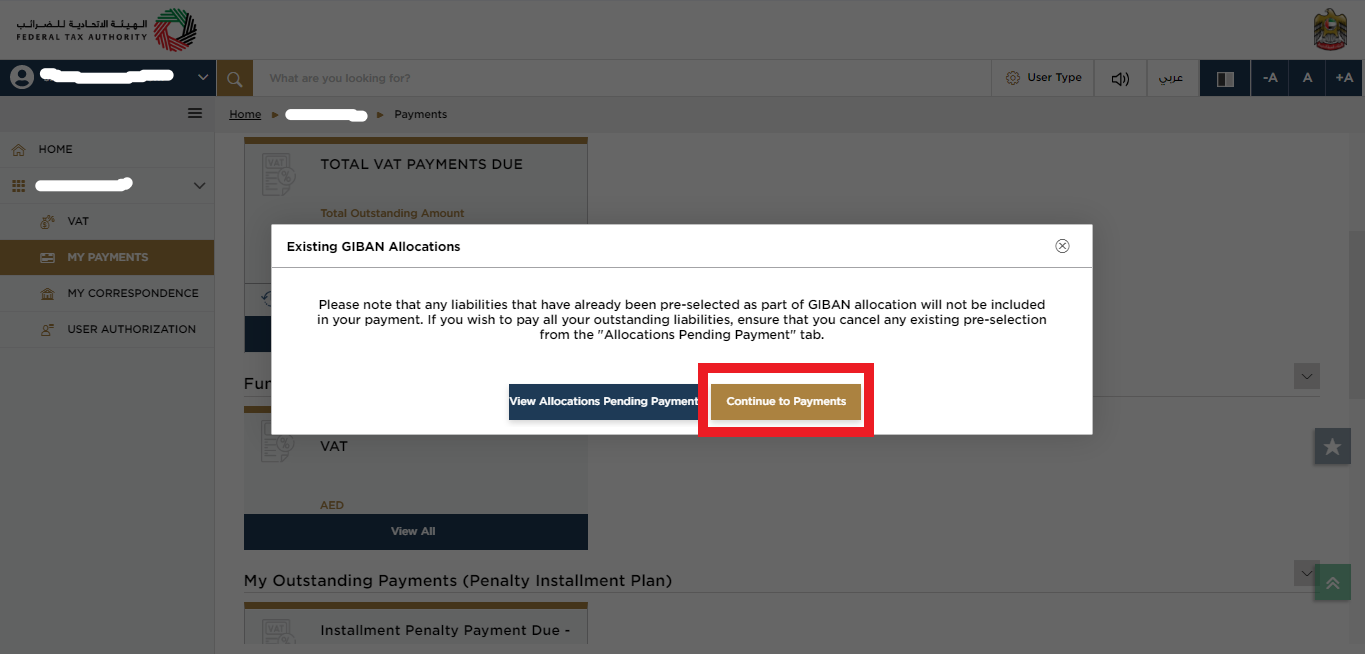

Step 4 - If you choose 'Pay All' then Click on 'Continue to payments'

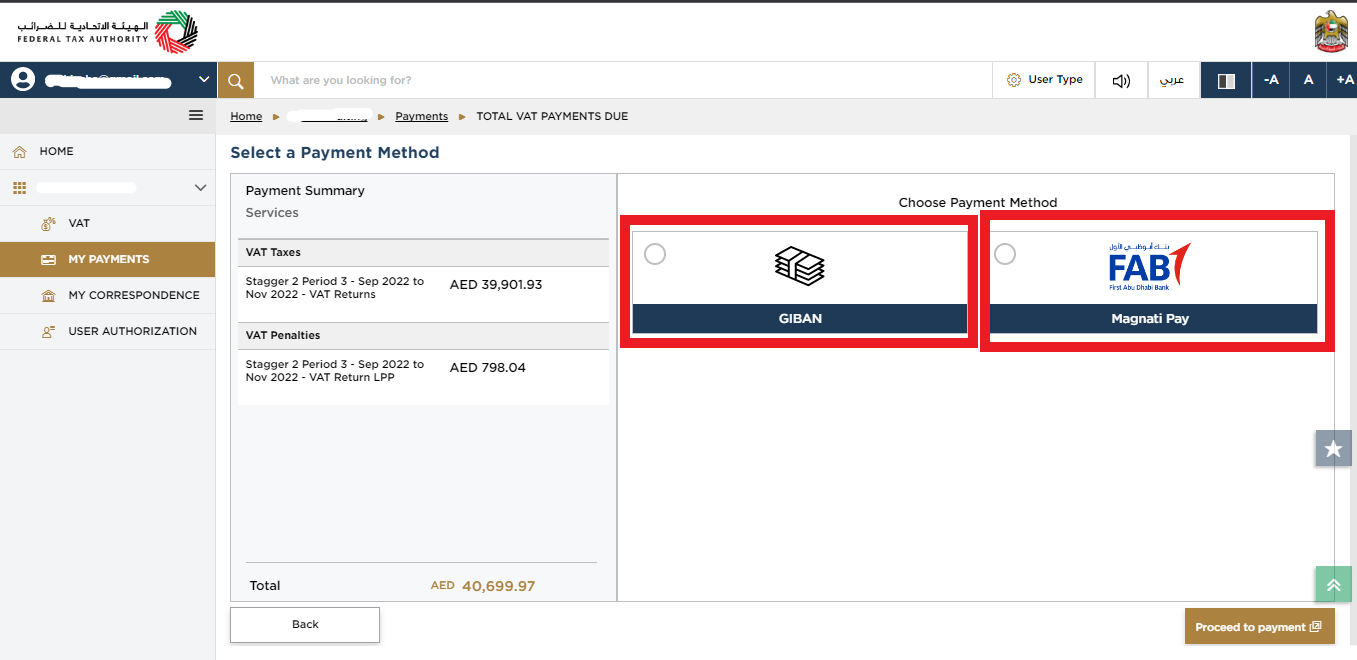

Step 5 - You can make a VAT payment via GIBAN method or FAB Magnati Pay. Click on 'GIBAN'

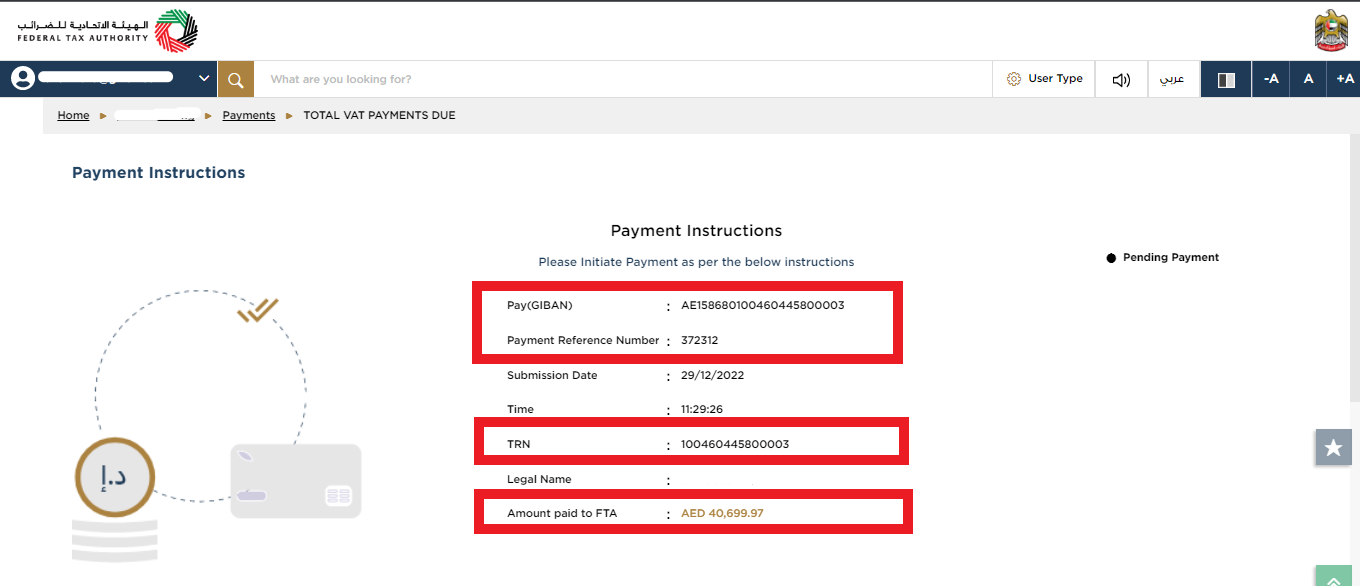

Step 6A - Once you click on 'GIBAN', it will show the payment instructions with your GIBAN along with the Payment reference number.