In the UAE, businesses with an annual turnover of AED 375,000 or more must register for VAT. Once registered, companies must charge VAT on taxable goods and services they provide to their customers and submit regular VAT returns to the FTA. The VAT certificate serves as proof of a business's compliance with VAT laws and regulations in the UAE.

VAT Certificate

A VAT certificate is an official document issued by the Federal Tax Authority (FTA) in the UAE that certifies a business is registered for Value Added Tax (VAT) and is authorized to collect and remit VAT to the government.

Obtaining the VAT Certificate is the last step of the VAT registration process. This document is issued by the Federal Tax Authority (FTA) with a unique number called Tax Registration Number or the TRN.

VAT Registration Certificate includes the following information:

- Details of the applicant

- TRN number

- Tentative date for registration

- The first term and the due date for VAT return

- Start and end dates of the tax period

How to Obtain a VAT Registration Certificate through EmaraTax?

Since EmaraTax is the UAE’s new platform to handle all the Tax procedures digitally, you can find all your registered tax certificates in the EmaraTax. For FTA account users, EmaraTax migrates your Tax certificates from e-services once you migrate your account to the EmaraTax.

For new taxpayers, log in to the EmaraTax and register for VAT by following this video.

It is always recommended to rely on firms that provide professional VAT Services in UAE and can help you with the VAT Registration process by assisting in tax compliance, document preparation, etc.

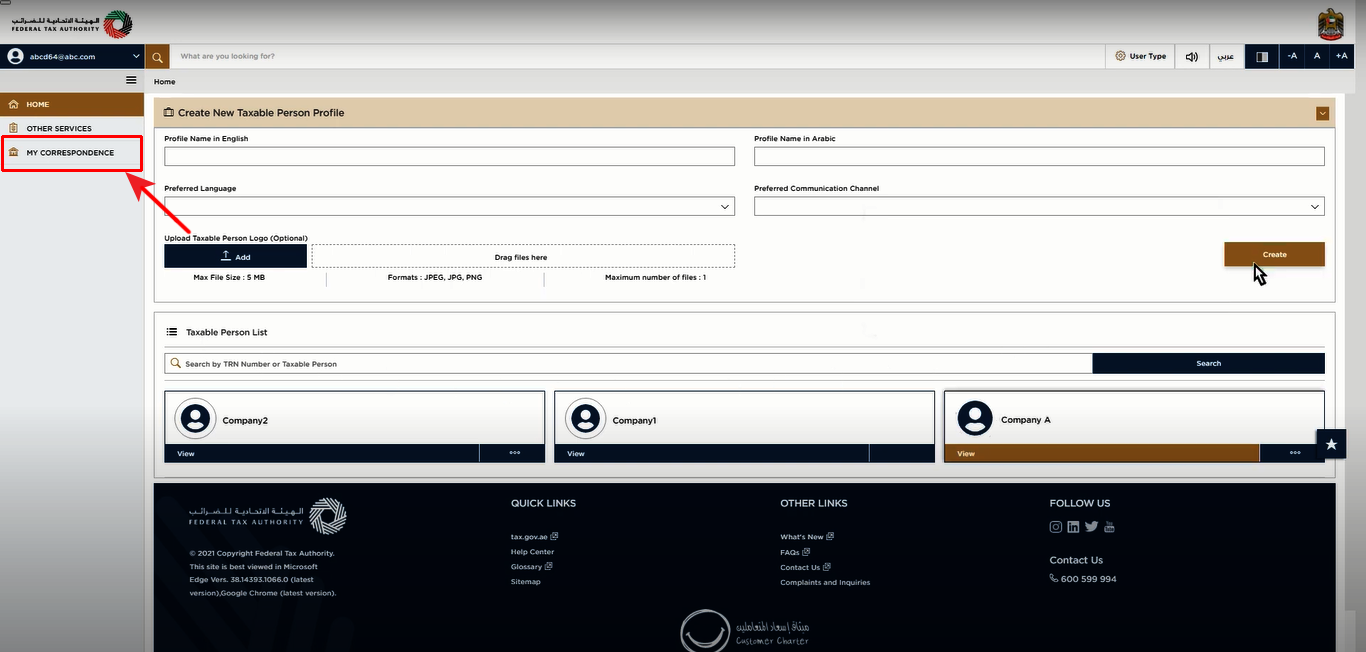

Previous taxpayers can download their VAT certificates in the My Correspondences section in the Emaratax or use the VAT certificate service given by FTA. Let's see how to do it below.

Read how to make VAT Payments in Emaratax through Giban and Magnati

Steps to download VAT Registration certificate for previous taxpayers

- Login to the EmaraTax Platform using Emirates ID UAE Pass or your taxpayer account.

- In the Dashboard, the VAT registration certificate can be found in the "My Correspondences section of your Taxable Person account.

- Click the certificate and download it as Pdf.

Note: If you are an old user and your tax registration certificate was not available as a pdf document in your dashboard in the old account, then you will not be able to find it in your EmaraTax dashboard.

In such a case, to receive an updated registration certificate, you must submit a VAT registration amendment application to the FTA via EmaraTax with your updated information (for example, trade license, Emirates ID, Contact details, etc.). Your registration Certificate will be provided once the FTA approves your application.

Steps to obtain VAT Registration certificate for newly registered taxpayers

Once you register for VAT in EmaraTax, you can view this payment in your Transaction History, and you can download a copy of the receipt. However, here are the steps to obtain the hard copy of the VAT Certificate:

- You can file an application form through the FTA VAT Certificate service

- In response, the FTA provides you with a Request number, which you could use to make the payments for the fees on the EmaraTax portal

- The FTA Service fee for VAT Certificate is 250 AED which you need to pay through the portal and obtain a payment reference number. You could use an E-Dirham card, or a Debit/Credit Card

- Once the payment is done, you will receive the payment confirmation through the mail and the FTA will print a physical copy of your requested certificate and mail it to your registered company address.

You can also get VAT Certificate service from Dubai Customs for 100 AED + additional charges.

How to download the VAT return in Emaratax?

As of now, FTA allows you to only download an acknowledgment for returns submitted in EmaraTax. To get that,

- Login to Emaratax

- File for VAT Returns with appropriate documents

- Complete the payment

- Once you submit your VAT return, you can find the acknowledgment screen.

- Click and download the acknowledgment screen

- Also, the FTA will send you an email to confirm your refund submission in EmaraTax.

Tax Agents in UAE

BMS Auditing is the pioneer in providing world-class VAT registration services through the FTA Registered Tax agents in UAE who have professional access to the EmaraTax. Our team is extensively knowledgeable and experienced in assisting clients with VAT Registration and receiving the VAT Certificate through the EmaraTax portal.

Need help with downloading the VAT Certificate through EmaraTax? BMS auditing dubai is just a call away!