Everyone must use the Emaratax portal offered by the Federal Tax Authority (FTA) to register for Tax and apply Tax Registration Number (TRN) in the UAE. A Tax Registration Number (TRN) is a unique identification number for individuals and businesses in UAE to fulfill tax obligations and comply with laws.

The FTA provides registered entities with this unique number to distinguish them from other entities. Documents required by the government, such as the filing of a VAT return, a tax invoice, a tax credit note, and others, must include a reference to the TRN.

The Federal Tax Authority uses the 15-digit Tax Registration Number (TRN) to distinguish particular people or businesses from others. The person who receives a tax identification number is known as a "Registrant," and they are required to consistently include this number in legally required documents like VAT Return Filing, Tax Invoices, Tax Credit Notes, and similar ones.

A company or individual will automatically receive a Tax Registration Number (TRN) after they register for VAT in Dubai. Companies must include the TRN in their documents for the government to track and record all of the transactions that are made by the company or individual. This guarantees accurate tracking and accountability for financial activities.

Only business owners or traders with a TRN certificate are permitted to charge VAT on their clients. Companies in the UAE are not allowed to charge VAT to their customers without a Tax Registration Number (TRN).

Eligibility Criteria for VAT Registration and to Get TRN in UAE

Every firm operating in the UAE must abide by state laws, including VAT regulations, to be eligible for VAT registration and get a Tax Registration Number (TRN). Additionally, the business must fulfill the following revenue requirements:

1. Voluntary Registration Requirements for VAT and TRN in the UAE:

- The threshold for voluntary registration for VAT and TRN is 187,500 AED.

- If a company's turnover is greater than 187,000 AED but less than 375,000 AED, it might choose to register for VAT.

- Businesses with annual revenue under 187,500 AED don't need to register for VAT.

2. Mandatory Registration Requirements for TRN in the UAE:

- The mandatory TRN registration threshold is roughly 375,000 AED.

- A company must register for Value Added Tax (VAT) if its revenue is expected to exceed this cap in the future month or has already done so in the previous 12 months to avoid paying substantial fines and penalties.

Steps to Apply for TRN in UAE

To be in compliance with the various tax systems, such as VAT, Excise, or Corporate Tax, one must register for each individual tax through the EmaraTax system and get the relevant Tax Registration Number (TRN). To ensure compliance and receive the correct TRN, each tax requires a unique registration procedure. Follow these easy steps to apply for online VAT registration and get your TRN number in the UAE:

If you are a new Tax registrar, sign up for an FTA account in the Emaratax portal using your UAE ID pass, then

- Log into your EmaraTax account and verify your email.

- You can access your EmaraTax account using the UAE Pass or your registered email.

- After successfully logging in, the user dashboard for EmaraTax online will show up.

- Select the VAT, Excise, or Corporate Tax Registration option from your dashboard.

- Make sure you are eligible and have all the necessary proof of eligibility.

- After reading the directions, click "Proceed" to move ahead.

- Following the instructions step-by-step, accurately complete the application form. To make registration simpler, think about employing a tax agent in the UAE.

- After submitting all of the required documents and completing the application, click "Submit."

Struggling with VAT Registration in UAE? Read, How to Register for VAT in UAE? (Step-to-step Guide). To make your complications easier, get a quote for our VAT Registration services in UAE

Where to Find My Tax Registration Number (TRN)?

In the VAT (Tax) Certificate, After your registration application is approved, you will be registered for VAT and get a VAT TRN (Tax Registration Number), Generated International Bank Account Number (GIBAN), and registration certificate. The registration certificate is available for download from your EmaraTax account.

How long does it take to obtain TRN Certificate in UAE?

In general, It will take 20 business days to process the application and get your Tax Registration Number (TRN) on approval.. However, if further information is required, FTA may require more time to complete the application.

Can I register for VAT using Excise Tax Registration Numer?

No, The Federal Tax Authority (FTA) will assign you a specific Tax Registration Number (TRN) for VAT purposes after reviewing and approving your registration. However, If you have already registered for Excise Tax, the process might go more quickly because some profile-related data might be prepopulated.

Note: Please be aware that for VAT purposes, you are only permitted to have one Tax Registration Number (TRN) at any given time. To maintain compliance, it is essential that you avoid submitting duplicate applications. It is your obligation to ensure its accuracy and uniqueness.

Documents required to obtain TRN

To get a TRN number for your company in the UAE, you must submit the necessary documents to the relevant department. You can get help from BMS, a renowned and skilled tax consulting expert, to get the TRN number. We quicken TRN registration by streamlining the procedure and making it simpler. The following is a list of possible supporting documents you may have to provide:

- Company’s MoA

- Company’s trade license

- Import or export declarations

- Company Bank Account Details

- Company’s turnover declaration letter

- Company’s contact details and address

- Emirates IDs of the shareholder/manager

- Passport copies of the shareholder/manager

- Last Year’s income statement and bank details

- Sample invoices from the suppliers and customers

How to Verify TRN Number?

The Federal Tax Authority's online platform now offers businesses and individuals in the UAE the ability to register and validate their TRN numbers. However, professional tax consultants like BMS can also help with TRN number verification in the UAE.

To verify your TRN number in the United Arab Emirates, perform the following steps:

- Visit the FTA's EmaraTax portal.

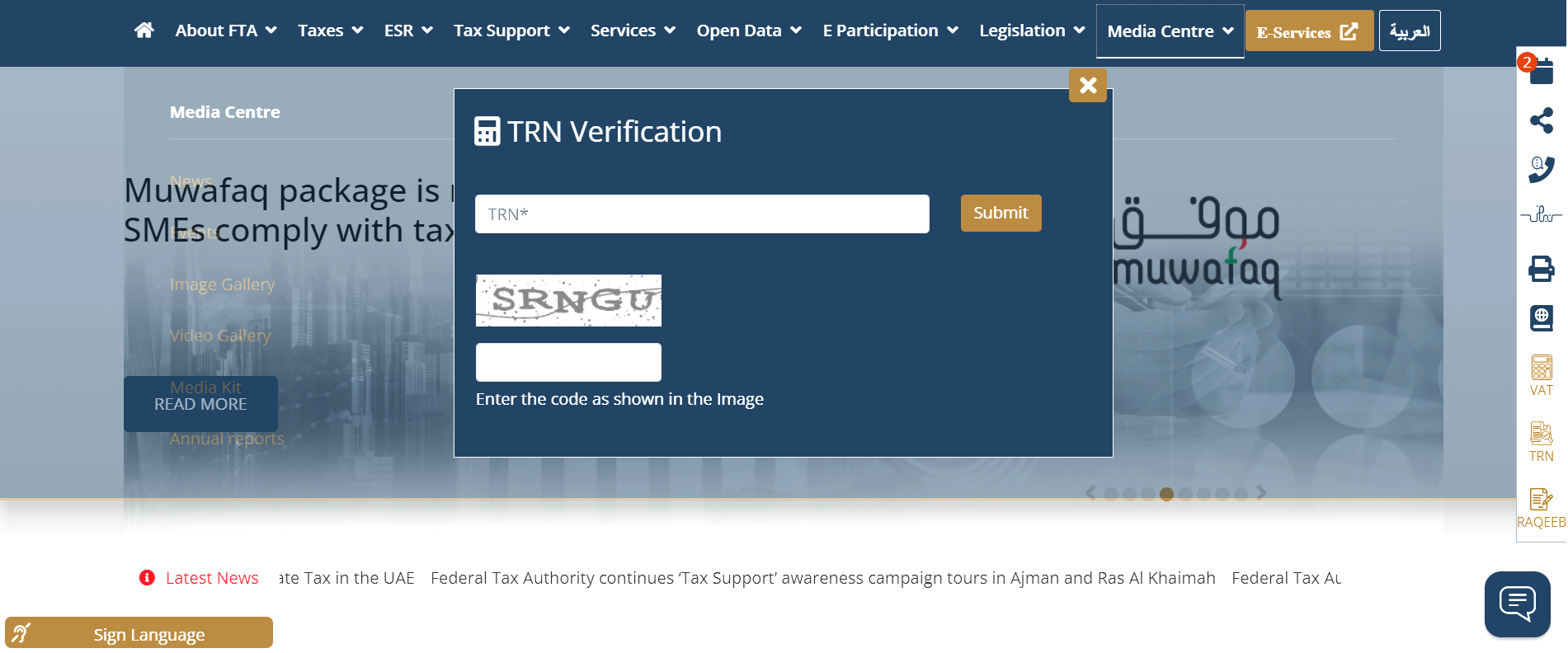

- Locate & Click the "TRN Verification" option from the menu on the right side of the page.

- In the space provided, enter your TRN number.

- Type the code shown in the image

- Click submit to see the verification status of your TRN.

VAT Consultants in Dubai, UAE

BMS Auditing is a renowned Audit firm in Dubai, UAE to offer comprehensive company setup and tax consultancy services in UAE dedicated to helping investors achieve compliance with UAE laws and promote uninterrupted business development. Our team includes highly qualified professionals, including tax experts, VAT Consultants, accountants, bookkeepers, auditors, and business experts. They are all a great fit for your company because they all have several years of experience in their respective fields.

We can help if you require VAT services in Dubai. Our extensive range of services includes Audit, Accounting, VAT, Excise tax, and more in addition to assisting with VAT registration. Please contact BMS auditing dubai if you would like more information about our services. We are eager to provide our assistance and guidance.

Ready to apply for your TRN? Contact us today for expert assistance on TRN Application Services.