You can request and claim VAT Refund in UAE by login to the EmaraTax, request for a VAT Refund form, fill in the details and submit the required documents. Every citizen of the UAE who is paying taxes can request a VAT refund. The only criterion is that the input tax should be greater than the output tax to claim a VAT refund.

EmaraTax is a platform introduced by the UAE to control all tax procedures at one point where you can also request and claim a direct and indirect VAT refund. For all tax-related tasks, including registration, filing, payment, and refunds, EMARA TAX provides a one-stop shop.

Why should you Claim VAT Refund in UAE?

Companies should claim VAT refund in UAE to recover the input VAT paid on eligible business expenses, such as supplies and services, which can reduce their overall cost of doing business and improve their cash flow. It also helps to promote fair competition, as companies are not burdened with the cost of VAT on their business expenses.

Let us see the step by step VAT refund process on EmaraTax to request a VAT 311 refund.

How to request for VAT Refund Online?

You can request and claim VAT Refund in UAE by login to the EmaraTax, request for a VAT Refund form, fill in the details and submit the required documents. Follow these steps to successfully submit your VAT Refund request to the FTA through Emaratax and claim the VAT Refund online.

1. Log into the EmaraTax

- First, log in to the EmaraTax account using your login credentials or UAE Pass.

- If you don't have an EmaraTax account, create one by clicking the signup button.

- Once logged in with user credentials, you will be redirected to a User Dashboard.

2. Request for VAT Refund form

- Select the user type as Taxable Person. Then, click on the proceed button. The View button will show you the Home page.

- You can also select ‘Tax Agents’, and ‘Tax Agencies’. And ‘Special Refunds’.if you are applicable.

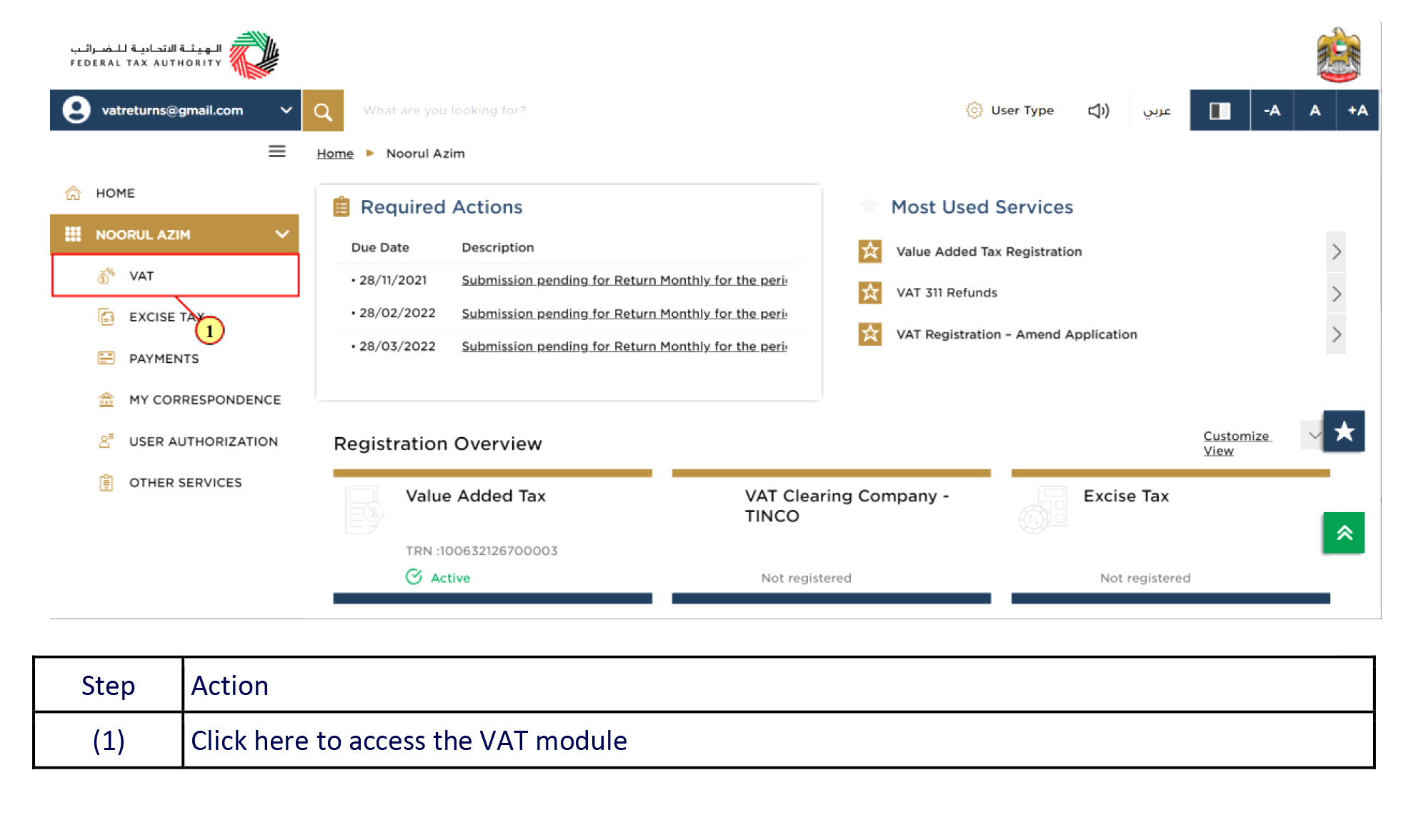

- In the left sidebar, you should select the VAT Module.

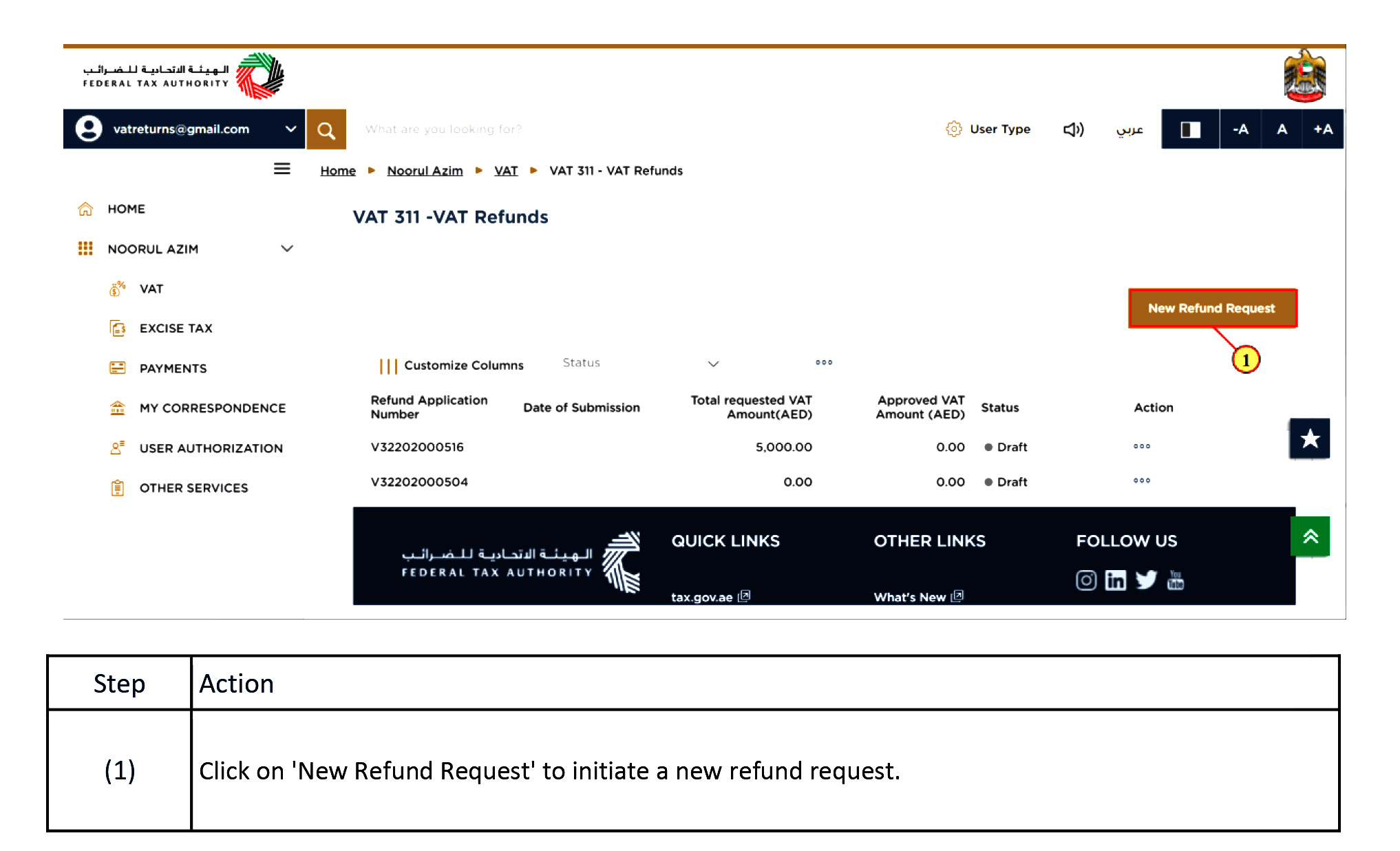

- Click New to create a new VAT Refund Request and your previous VAT 311 refund requests will be displayed here.

- By clicking the ellipsis, you can edit the Refund request.

- Click the 'New Refund Request' button to initiate your refund.

- Confirm the instructions and guidelines to show you have read and understood the terms and conditions and click ‘Next’

- Click on the Start button to proceed with the Refund request.

3. Fill up the necessary VAT Refund details

- Ensure the bank details before submitting the form.

- Enter the refund amount. It should be less or equal to the "Excess Refundable VAT Amount."

- Click ‘Add Supporting Details’ to see corresponding VAT Refund

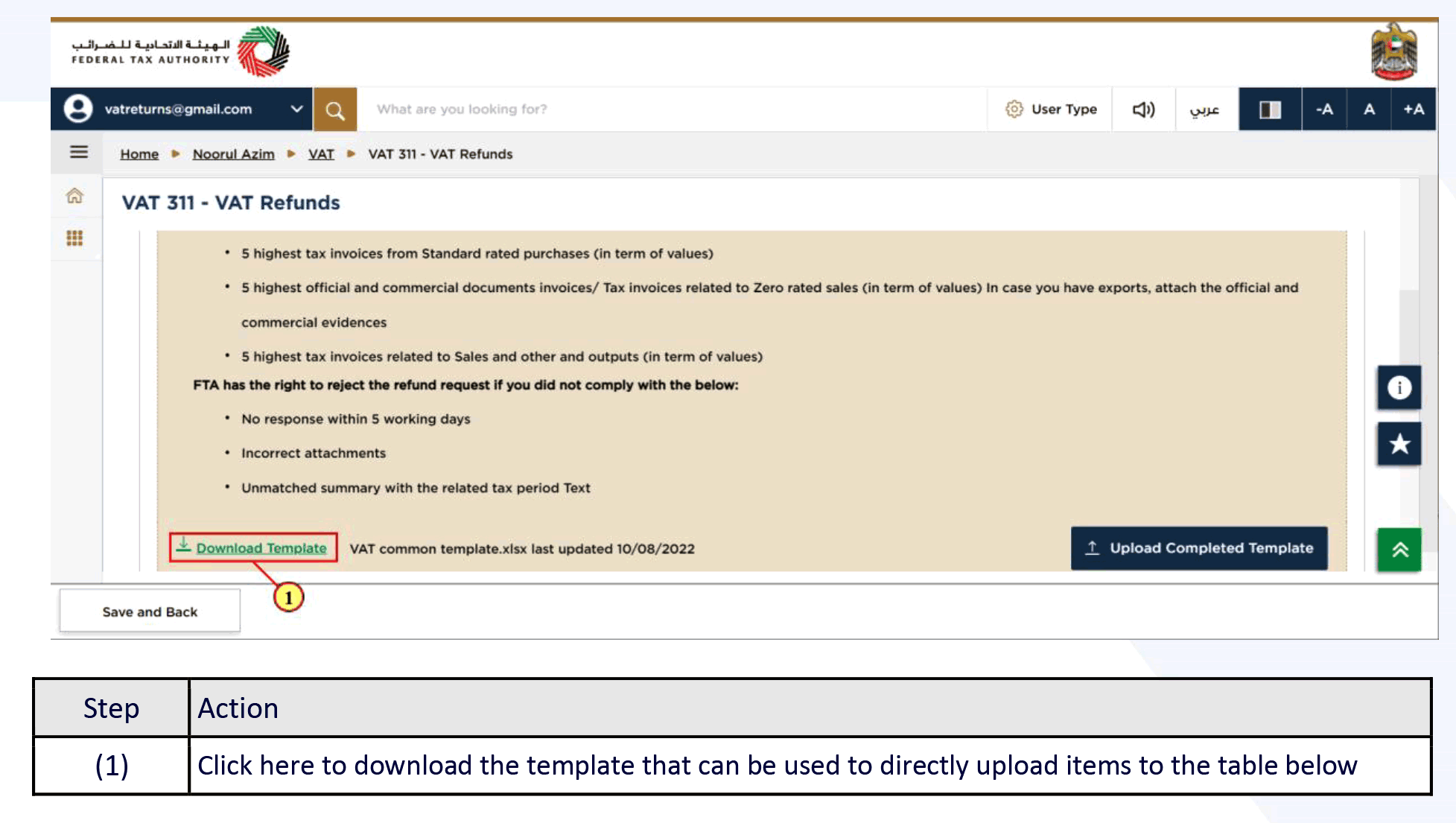

- Click the ‘Download Template button’, fill in the template and upload the template.

- Click the edit button to give the further required details like contact details, VAT Supplies, etc.

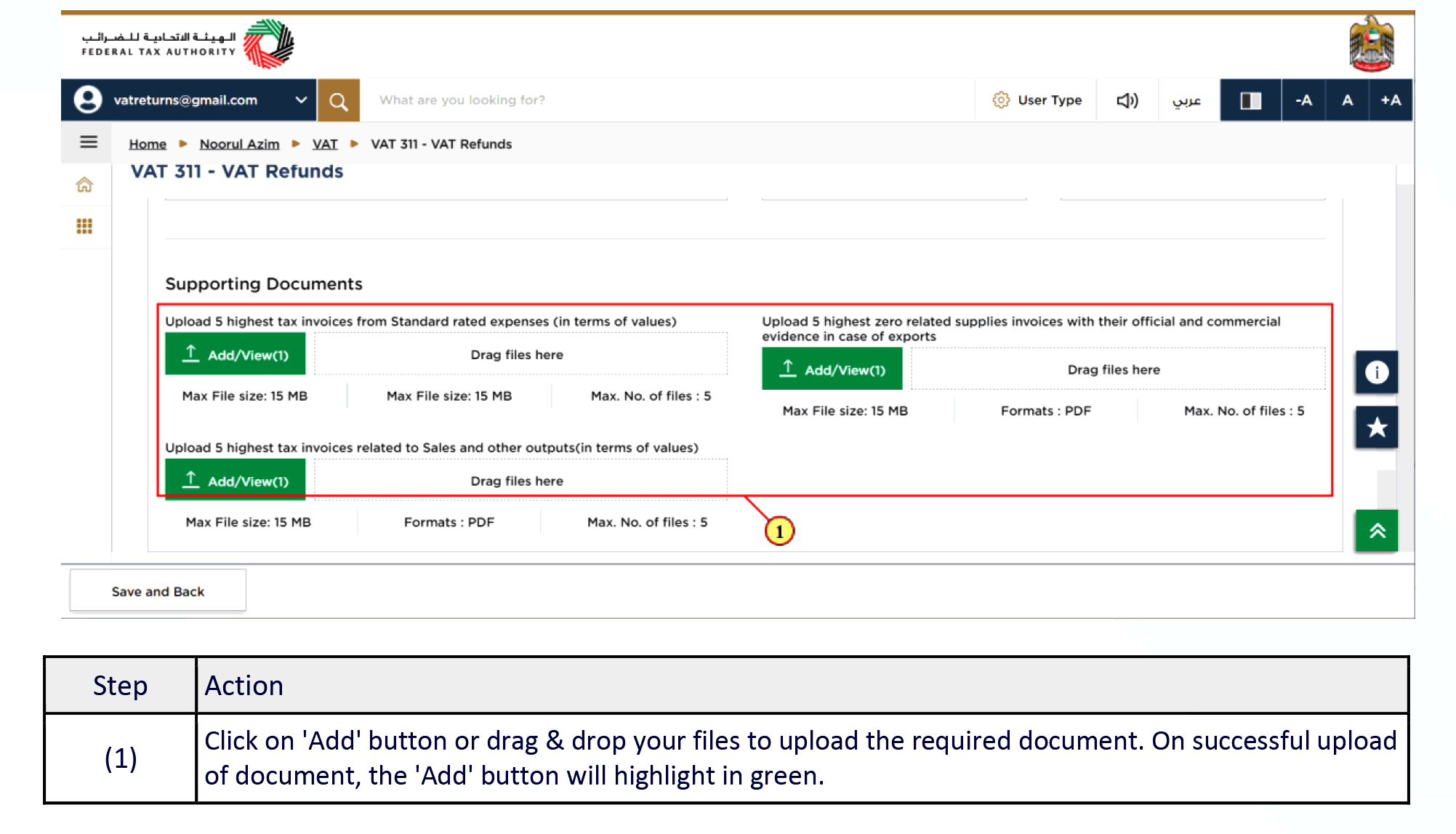

- Click the add button to upload the required document. On successful upload of the document the button changes to green.

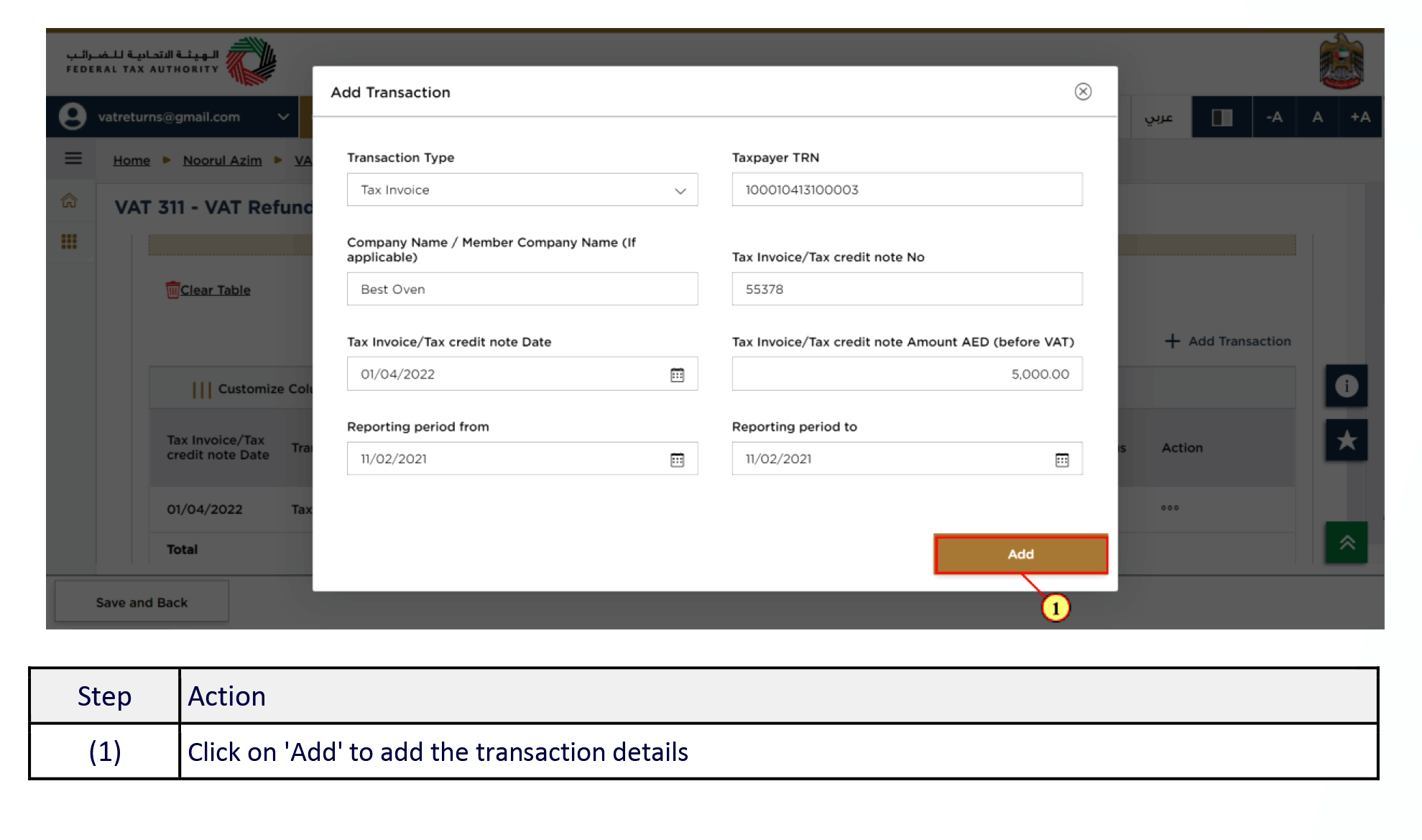

- Click the “add transaction” button to add the transaction details. Then press add Transaction.

- To save click the ‘Save and Back’ button.

- ‘Next’ button will take you to the completed Refund Request. You can review it before submission.

- Click on each step to review every section

Mark the checkbox to confirm that you have agreed to the terms and conditions on this refund screen and submit it by clicking the ‘submit’ button. Note down the application number for future reference.

On successful submission of the form, you can access the refund request from the VAT tax module.

Correspondences

After the submission of the Request Refund form, you will get the acknowledgment for submission, approval or rejection notification and additional information notification. You can also download the acknowledgment in the correspondence section in Emaratax where VAT certificates can be found.

Documents Required to Claim VAT Refunds in UAE

- A bank account validation letter or certificate must be given to the FTA if your bank is foreign. Your bank must issue this letter, which must include information about the account holder's name (which must match the taxpayer's name as registered with the FTA), your bank's name, address, SWIFT/BIC, and IBAN.

- You must include supporting evidence (such as proof of payment) if you are asking for a refund of excess credit that was paid in error or a transfer from another TRN as a result of an inaccurate payment.

- It is advisable to have the following documentation available to support your request for a refund of an excess credit that resulted from filing a tax return.

- The top five tax bills (in terms of value) from standard-rated purchases.

- The five biggest tax invoices or invoices relating to sales that were not taxed (based on values). Attach the official and commercial evidence if you have exported.

- The five biggest tax invoices relating to outputs, sales, and other items.

Procedure to Update the Bank Details in VAT Refund Request

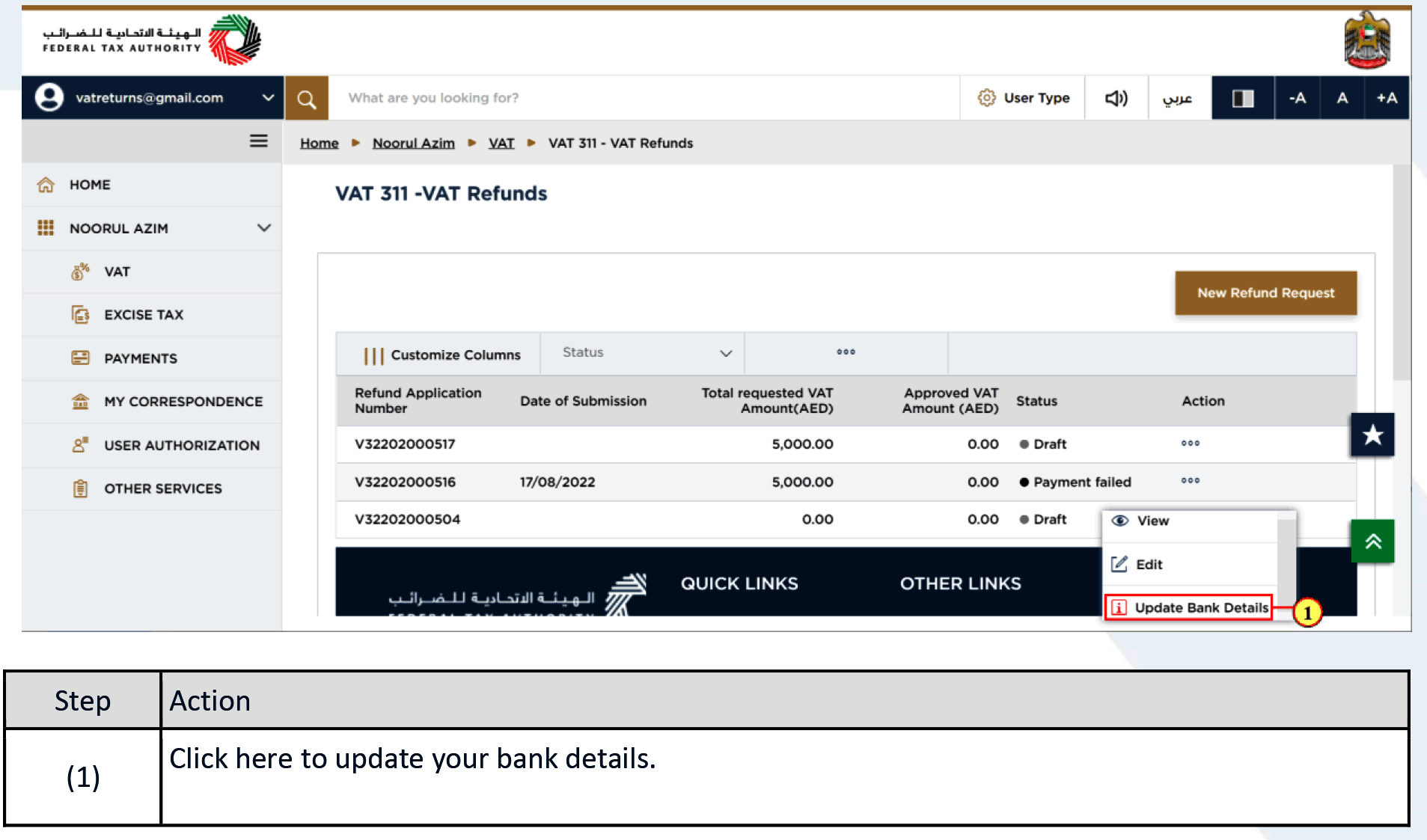

In rejection of VAT Refund or non-receivable refund, an error in the Bank details has been the issue most of the time. You can update it in the Emaratax dashboard and apply for VAT Refund again. Here’s how you do it.

- Follow the same steps in Apply for VAT Refund on Emara Tax up to Step 2.

- Then select the entry of which the status of the application is shown as ‘Payment Failed’.

- From the ellipsis, click on the update bank details button. Then, select “Enable Editing”, to edit the bank details. Upon selection, the fields in the section will become editable.

- Give all the required bank details, upload the necessary document, and click the next step button to proceed further

- Then follow the same steps as in Apply for VAT Refund on Emara Tax

VAT Refund for Non-Taxers in UAE

The Tourists can reclaim VAT paid on their purchases when departing through Abu Dhabi International Airport. The UAE Federal Tax Authority announced it on November 18, 2018.

According to the present regulations, GCC nationals are eligible since Tax-Free Shopping is open to everyone who is not a resident of the UAE.

Purchasing items in the UAE for export (subject to limits and conditions) is tax-free shopping. Customers who authenticate their purchases under regional regulations may be eligible for a refund on certain goods.

Process of VAT Refund for Non-Taxers

- A tourist who wants to make a tax-free purchase must show a valid passport.

- The shop employee uses the system to record tourist data.

- The shop employee then adheres to the Tax-Free sticker on the sales receipt's back.

- The visitor must authenticate the purchase at the airport when a Tax-Free digital form has been prepared.

Period for Refund

You have 90 days from the date of purchase to validate your tax-free tag. For instance, a form that was issued on January 1 is valid through April 1. If you don't do this, the Tax-Free tag expires, and you can't claim the VAT anymore.

How to Collect Your VAT Refund in UAE?

- The traveler brings the items and the receipt with them to the airport. The traveler visits a validation station.

- After validation, the traveler selects a refund method. (Please note that the tourist may be subjected to a second validation check and may need to submit the goods for examination).

- Reimbursement Process- Cash (each tourist may receive a maximum cash refund of 10,000 AED. Over this sum, all additional payments must be made with a credit or debit card.

VAT Refund Services in UAE

BMS Auditing is a leading VAT consultancy firm in Dubai, offering a fast VAT Refund Services in UAE to businesses and business travelers. Our VAT consultants can assist businesses in identifying eligible expenses and preparing the necessary documentation to claim a VAT refund.

The process of claiming a VAT refund can be complex and time-consuming, but with BMS Auditing's expertise, businesses can have peace of mind that the process will be handled efficiently and accurately.

FAQ'S

1. How long can a VAT refund take in the UAE?

After the approval of your refund application, it takes five business days to get your refund amount credited.

2. What is the current VAT rate in UAE?

The standard rate is 5% for goods and services. Some goods have a 0% VAT rate.

3. How do I check the status of my VAT refund in Emara Tax?

Log in to the Emara Tax account and can check the status of the refund in the VAT Module tab. It will display the status as processing, rejected or refunded.

4. What is the Emara tax in the UAE?

Emara tax is A modern and comprehensive tax platform in UAE

5. Who is eligible for VAT free?

For aged people who are above 60 and for disabled can get VAT free.

6. What VAT services does BMS Auditing offer?

BMS Auditing provides a range of VAT services, including:

- VAT registration

- VAT return filing

- VAT compliance audit

- VAT advisory and consulting

- VAT deregistration