BMS Auditing provides reliable VAT refund services in UAE, KSA, Qatar, Bahrain, Oman, and UK for Businesses and well as tourists to quickly claim the VAT Refund. You can claim a VAT refund when the input VAT is greater than the output VAT. Moreover, the Output tax is the tax imposed on sales of a business whereas the input tax is the tax collected on purchases, expenses, and imports of businesses.

VAT Refund

VAT Refund is the process by which businesses or tourists can claim back the VAT paid on goods and services purchased in the Country. Foreign businesses or tourists who are not registered for VAT in the UAE or other countries can claim a refund of the VAT paid on goods and services purchased if they meet certain conditions and follow the prescribed procedures.

To be eligible for a VAT refund, the purchase must be made by a non-resident who is not registered for VAT in the UAE or other countries, and the goods or services must be for personal use or for the business's core operations.

The minimum purchase required for a tourist to qualify for a VAT refund is AED 250, and the goods must be exported within 90 days of the purchase. The Maximum VAT cast Refund you can apply as a tourist is AED 35,000.

Options for VAT Refund

The taxpayer has the following two options in treating the excess input VAT commonly known as VAT refund:

-

-

-

- The taxpayer will be eligible to request a VAT refund

- If he does not wish to request a refund of the excess input VAT, the excess recoverable tax will be carried forward to subsequent tax periods and can be used to offset against the payable tax and/or penalties, or he can apply for a refund later at any point in time

-

-

Document Required for VAT Refund Services

To claim a VAT refund through VAT refund services, foreign businesses and tourists are required to have certain documents. The documents required may vary depending on the nature of the claim and the specific requirements of the government to process the refund. However, some common documents required for VAT refund services in UAE are:

- Original tax invoices

- Proof of export of goods from the UAE, such as shipping documents or boarding passes

- Original receipts or credit card slips

- Passport or other identification documents

- The boarding pass or airline ticket for tourists

- Trade license and commercial registration for businesses

- Bank account details for the refund transfer

BMS Auditing has the most reliable VAT Consultants in UAE who can help you organize your document requirements and process VAT Refunds in an effective way possible.

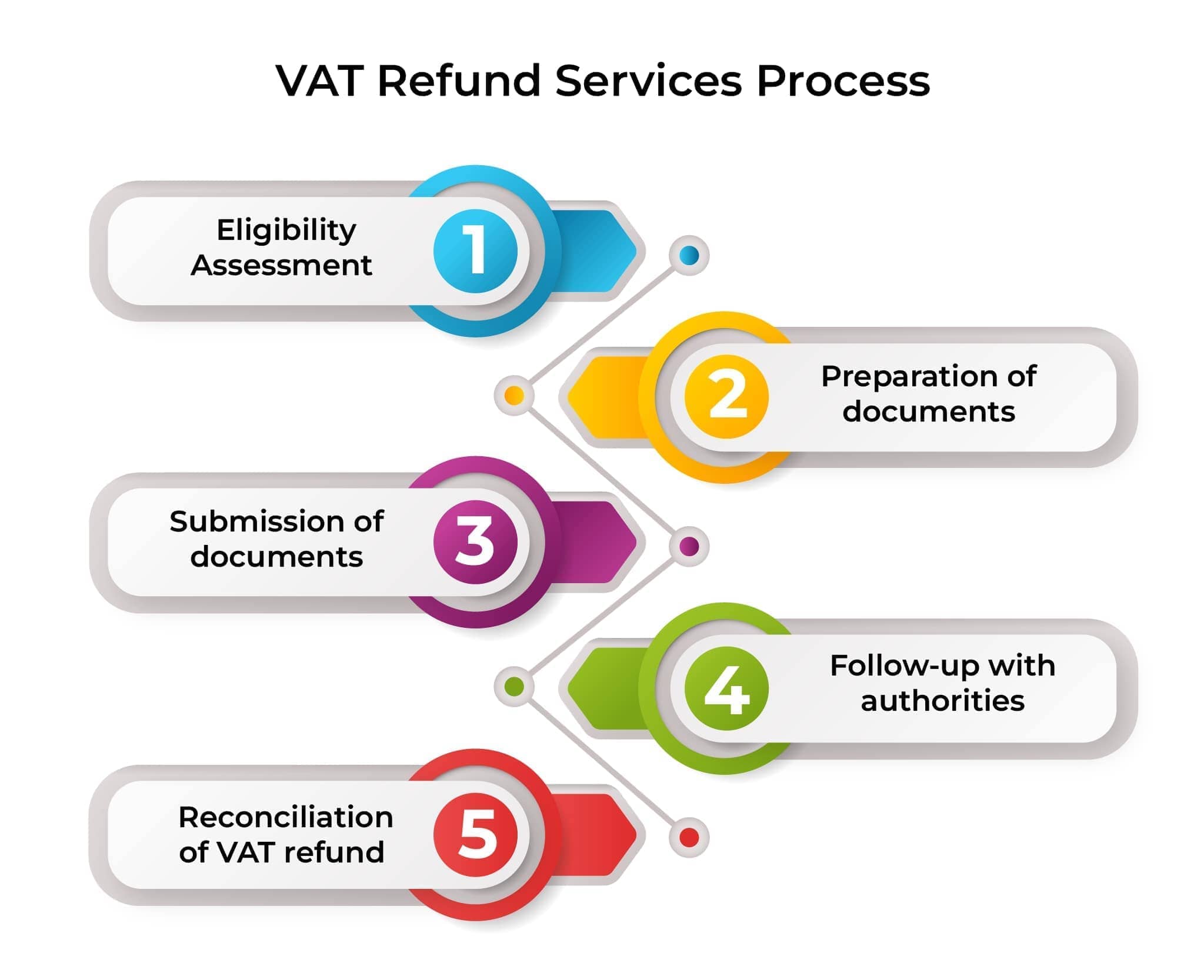

VAT Refund Service Process

VAT Refund Services in the UAE process include assessing eligibility, preparing and reviewing necessary documents, submitting them to the designated VAT refund office, follow-up with authorities, and reconciling the VAT refund received. By taking the help of our VAT Consultants, your business can ensure a hassle-free and compliant VAT refund process.

VAT Refund in Oman

On filing VAT Returns in Oman, If you qualify for a tax refund of over OMR (100), you can request the refund once all checks are done. The Tax Authority will decide within 30 days, and if approved, you'll receive the refund within an additional 15 days.

For refund amounts below OMR (100) or if you choose not to request a refund during tax return submission, the amount will be carried forward to future periods. At the end of the Tax Year, you can still request a refund if eligible by submitting a request before the due date of the first tax period in the new Tax Year.

Remember to make refund requests within five (5) years from the end of the tax period in which the right to a refund arose. After this period, the amount will be forfeited and no longer eligible for a refund.

VAT Refund Services in GCC Countries

Foreign businesses that have incurred VAT in the GCC VAT Implementing States (UAE, KSA, Oman and Bahrain) should assess their eligibility to claim the refund.

Where foreign businesses are eligible for a VAT refund, the refund application should be prepared along with prescribed supporting documents for submission to the tax authority of the State within a set deadline.

While tax authorities (such as the KSA tax authority) have not yet provided detailed guidance on the refund mechanism, businesses should take steps to preserve their entitlement for a refund of VAT incurred during the year by way of filing a formal application within the set timeline.

BMS Auditing has offices in Major GCC countries to offer holistic VAT Refund Services in UAE (Dubai & Abu Dhabi), Saudi Arabia, Qatar, Oman and Bahrain for businesses and tourists to rely on.

Claim VAT Refund

When you choose BMS Auditing, you will be joining a diverse list of businesses from various sectors that have greatly benefited from our efficient services. Your information will be completely secure with us and we will help you in every step of the way.

We are covering all the subjects related to VAT. We are providing the best VAT services and helping businesses to avoid VAT fines and penalties by guiding them in the right direction. Our VAT services consist of VAT registration, VAT return filing, VAT accounting, VAT audit, VAT refund and VAT Deregistration. We have professional and highly experienced VAT specialists who ensure VAT compliance by providing best VAT refund services.

Tax legislation and tax authorities will keep evolving and this, in turn, will also change the way taxes are being managed by corporates. In short, tax is an area that needs to be considered before making any key business decisions to ensure the corporate remains compliant and avoids undue penalties/liabilities or loss of reputation.