Our VAT deregistration services in UAE, KSA, Qatar, Bahrain, Oman, and UK will ensure eligible businesses cancel their VAT registration in the country. VAT deregistration, also known as cancellation or termination of VAT registration is typically done when a business needs to cancel its VAT registration with the Tax Authority. VAT deregistration is an online process to deregister from tax.

Types of VAT Deregistration

There are two types of VAT deregistration services, companies will choose one category before applying for VAT deregistration and it will be based on different reasons. Following are the VAT deregistration categories:

-

-

-

- Mandatory VAT Deregistration

- Voluntary VAT Deregistration

-

-

Mandatory VAT Deregistration

A taxable person should apply to deregister within 30 days if any of the following applies:

a. If they no longer carry out economic activities.

b. If the business has stopped making taxable supplies.

c. If they are no longer considered a legal entity. (Company Closed)

View this post on Instagram

Voluntary VAT Deregistration

A taxpayer can opt for VAT deregistration if:

a. The value of their taxable sales in the past 12 months is between the voluntary threshold and mandatory threshold.

b. The value of their taxable sales in the next 12 months (including the current month) is between the voluntary threshold and mandatory threshold.

View this post on Instagram

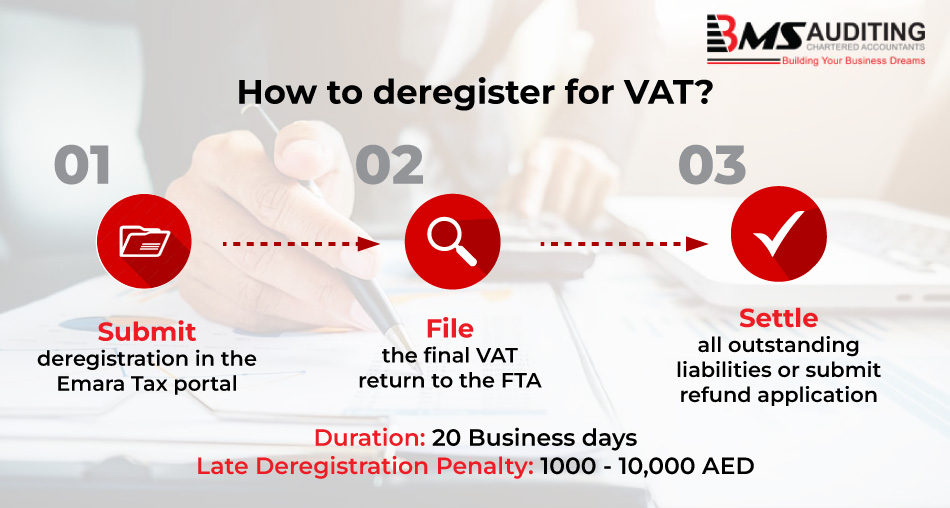

VAT Deregistration Procedure

The procedure to deregister for VAT in the UAE can be summarized as follows:

-

Prepare the Required Documents - Gather all the necessary documents required for VAT deregistration. This includes the VAT Deregistration Application Form, original Emirates ID and passport of the authorized signatory, a letter requesting VAT deregistration and the reasons for the deregistration request, evidence to support the reasons for the deregistration, VAT tax invoices and credit notes, financial statements, and a customs registration cancellation certificate (if applicable).

-

Settle Any Outstanding VAT Liability - Any outstanding VAT tax invoices and credit notes should be settled before submitting the VAT deregistration application.

-

Submit the VAT Deregistration Application - The completed VAT Deregistration Application Form, along with all the required documents, should be submitted to the Federal Tax Authority (FTA) through the EmaraTax portal.

-

Await Approval - The FTA will review the application and may request additional information if necessary. Once the application is approved, the FTA will issue a VAT deregistration certificate.

-

Update Records and Systems - Update your business records and systems to reflect the VAT deregistration. This may include updating accounting systems and invoices to reflect that your business is no longer registered for VAT.

Need more detailed steps to De register UAE VAT through EmaraTax? Click here, How to Deregister VAT in UAE?

Time Frame for VAT De-registration

A registrant must apply for VAT deregistration within 20 business days from the occurrence of the above-mentioned events. Registrants can easily apply for VAT deregistration by accessing their relevant tax authority portals. Additionally, Companies that are getting closed must have a company liquidation letter from the government authorities to apply for VAT Deregistration.

Businesses need to submit a final and last VAT return filing after getting the pre approval of VAT deregistration application. Once the last VAT return filing has been submitted and all the liabilities are cleared, tax authority will cancel the VAT registration.

Details to be submitted for VAT registration cancellation

An application to cancel VAT registration should be submitted to the authority on the prescribed form and include the following information:

-

-

-

- The name of the registrant

- The registrant’s tax registration number

- Reasons for and evidence of meeting the de-registration conditions

- Date of meeting the cancellation condition

- Details of the value of supplies in the last 12 months and an estimate of the value of supplies in the next 12 months.

- Details of the value of expenses in the last 12 months and an estimate of the value of the expenses in the next 12 months.

- Any other information determined by the authority.

-

-

Significance of VAT Deregistration

For taxable individuals and businesses, VAT deregistration process is as important as it is to register for a VAT. Businessmen must know the rules and process for VAT cancellation in UAE, KSA, Qatar, Bahrain, Oman, and UK, as administrative penalties will be imposed upon failure to file an application within the timeframe specified in the tax law.

How BMS can help?

Besides offering VAT deregistration services in UAE, KSA, Qatar, Bahrain, Oman, and UK, BMS provides various business services and VAT services that include CFO Services, Audit Services, Accounting & Bookkeeping Services, VAT registration and VAT filing services.

If you have any queries regarding the VAT De-registration process or about your current business, feel good to discuss with us. BMS Auditing is there for your support!

Our expert will give you a free VAT consultation to keep your uncertainties away!

- Forensic Audit

- AML Compliance

- Business Valuation

- Tax Audit

- Audit in Free Zones